making roads safer with sensor data

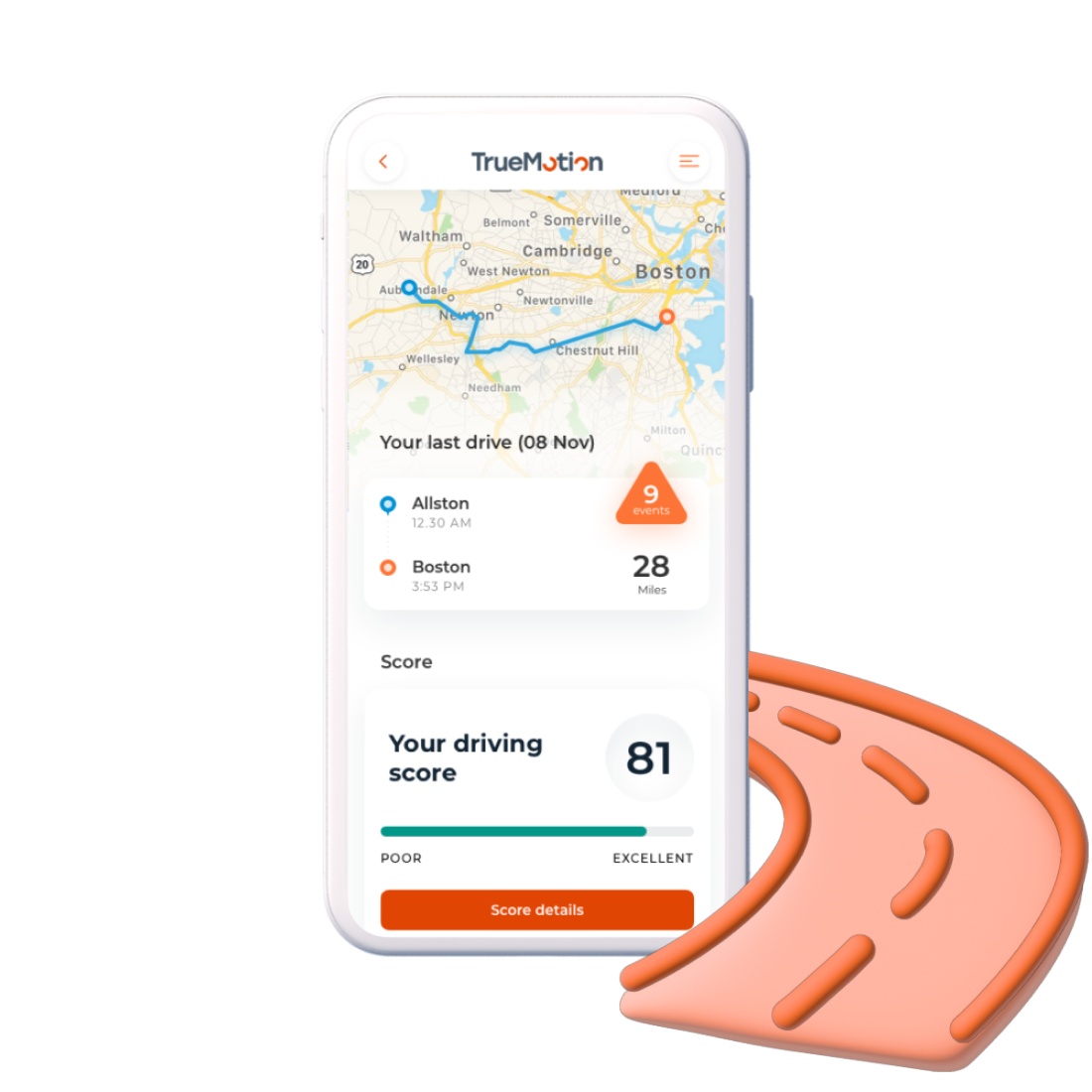

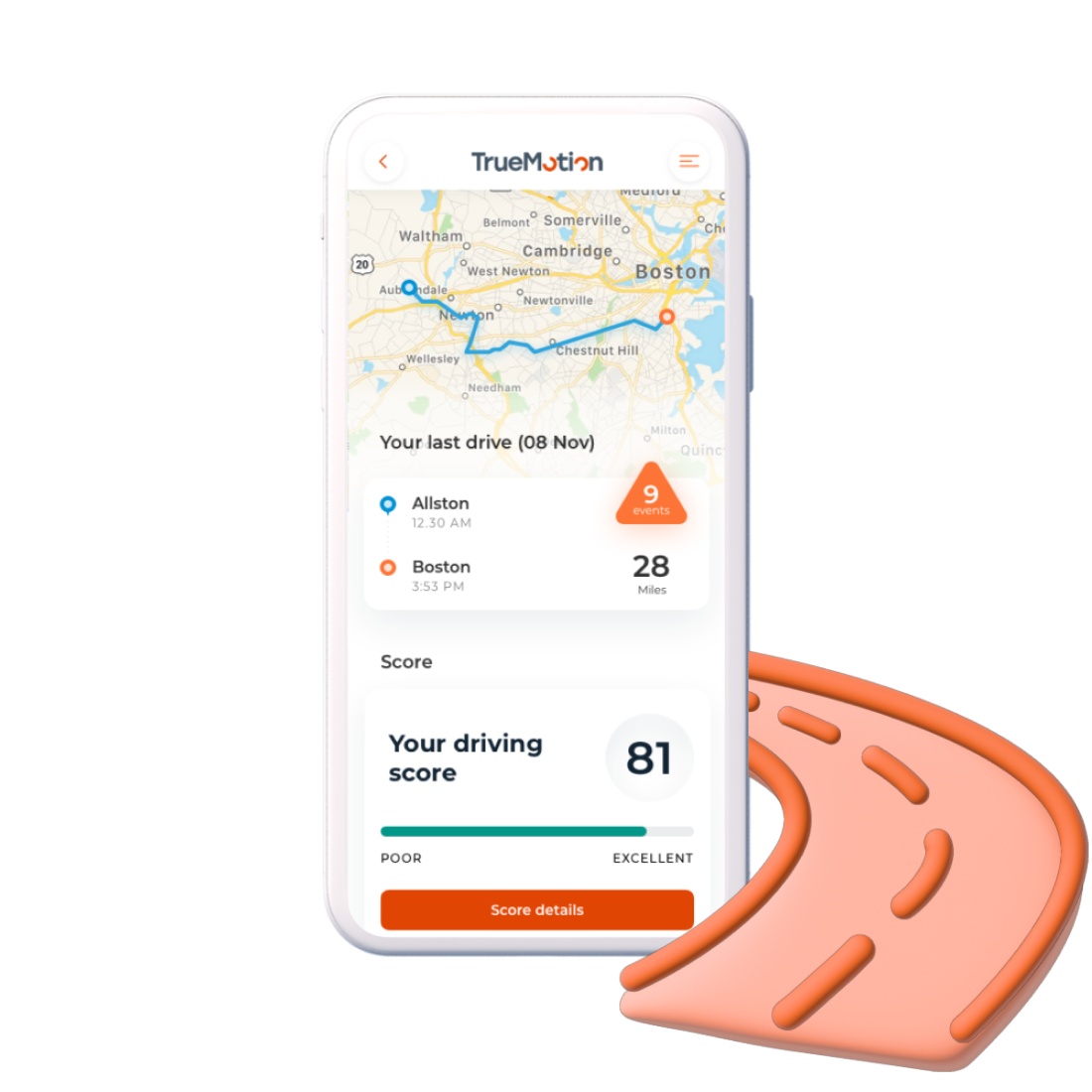

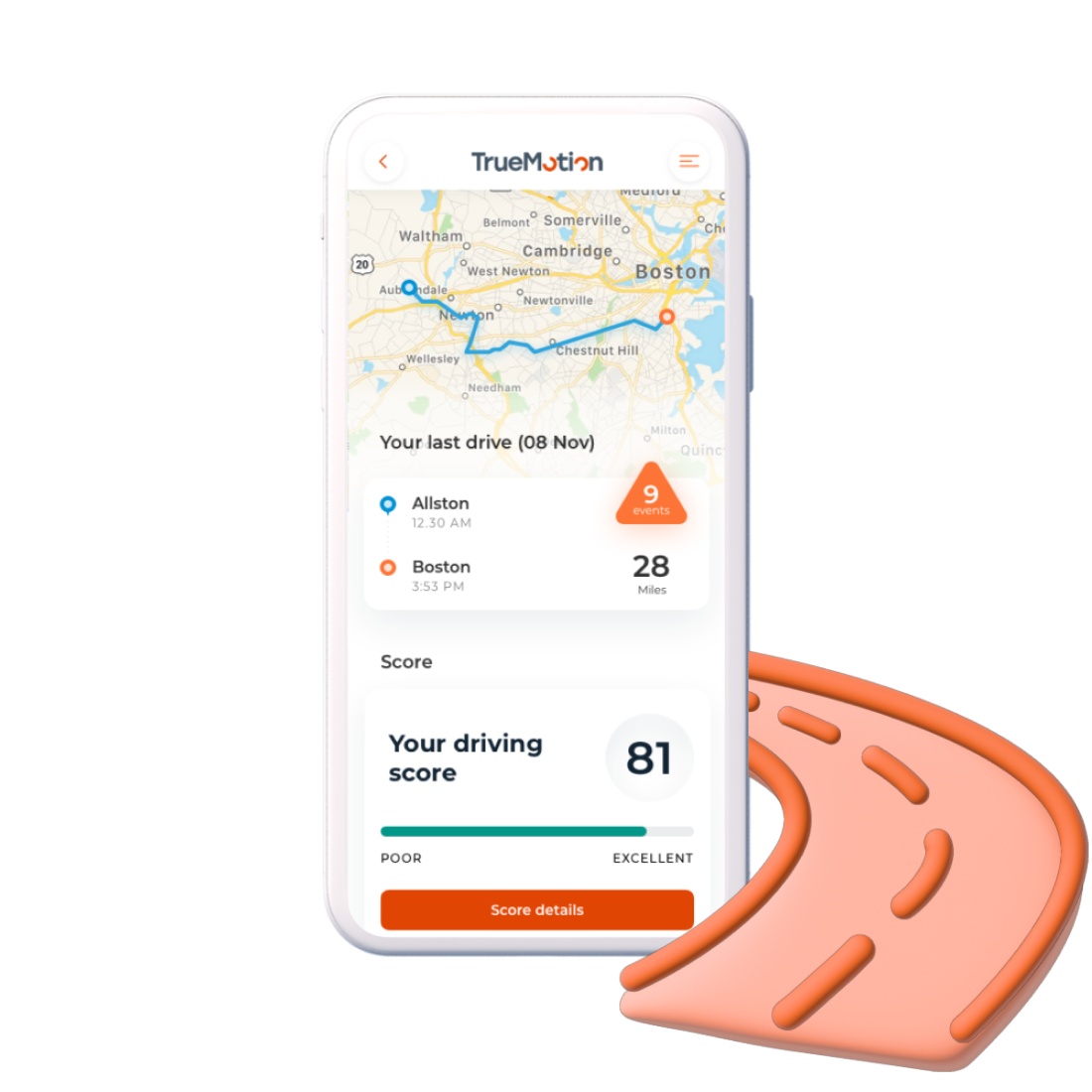

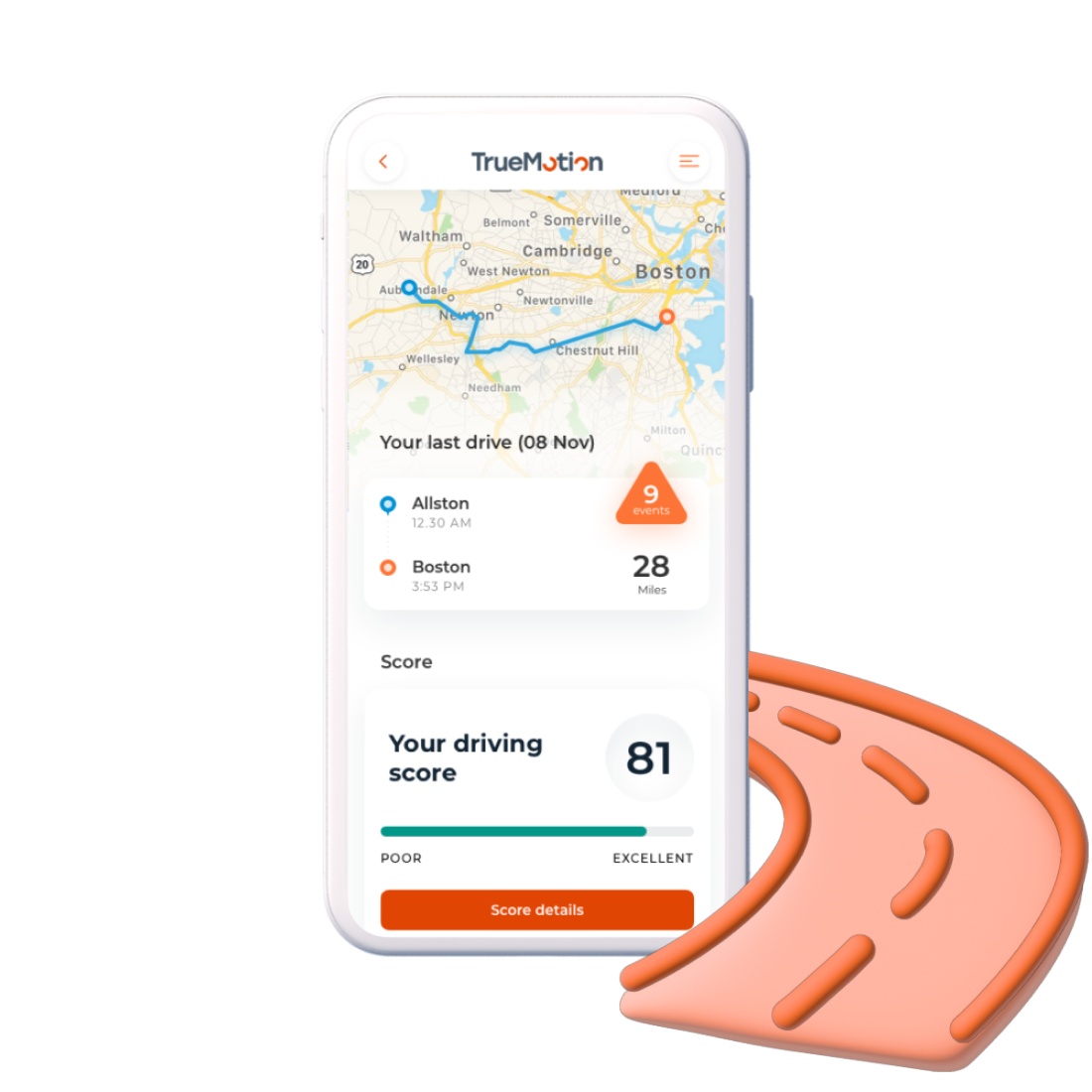

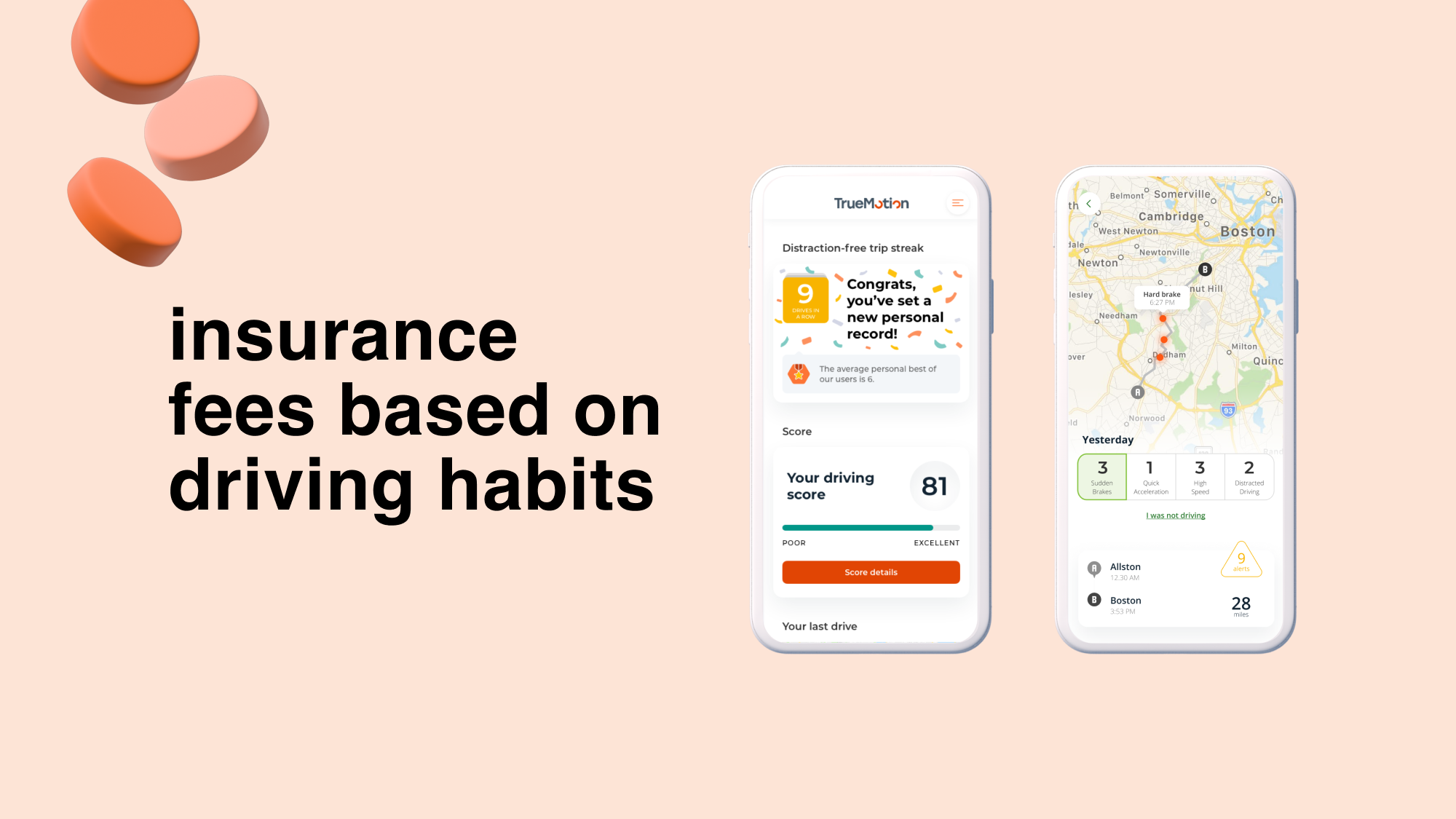

TrueMotion (part of Cambridge Mobile Telematics) is an innovative telematics platform that leverages powerful AI and Machine Learning algorithms to transform drivers’ smartphone sensor data into real insights.

TrueMotion's platform enables insurers to offer bespoke coverage to each of their customers based on a unique driver score derived from individual driving habits. In addition to better understanding driver behavior, TrueMotion’s crash detection functionality has critically assisted drivers in car accidents – fulfilling the primary mission of making roads and drivers safer together.

Carriers are under increasing pressure to provide products that meet the changing needs of customers while trying to remain profitable and competitive. TrueMotion enables drivers to get more favorable rates from their insurance carrier by creating mobile applications with partners like Progressive, American Family, and Farmers.

Supercharge handled mobile-related technical delivery for TrueMotion implementations, helping to scale the business and enabling TrueMotion to ship applications to their growing client base much faster.

As a result of growth, TrueMotion was acquired by Cambridge Mobile Telematics in June 2021.

TrueMotion focused on building connected insurance products, where premiums are highly dependent on driving behavior, as backed up by telematics data.

Insured customers with safer driving habits can receive better rates, and carriers can more easily classify and group policyholders - attracting low-risk drivers to the customer base and more accurately pricing premiums for customers with more problematic driving profiles.

Every time a new client reached out to TrueMotion, they had the same baseline needs regarding the core functionalities of their desired app, yet there was always a high volume of client-specific requests. Predictably, the code base grew with each new client, driving higher maintenance costs and time consuming, energy-intensive onboarding for new providers.

To reduce onboarding time for new partners, we had to find a way to rapidly create new and easily customizable applications. To scale the business, we needed to drive down maintenance costs.

the solution: a white-labeled mobile software development kit (SDK) that cuts onboarding time in half and reduces new app releases to 3-4 weeks, and a shared codebase to lower maintenance costs.

Building upon our proven digital methodologies and industry best practices, we provided scaleable and easily-maintained solutions to serve drivers around the world.

Providing our partner with the ability to ship their technology at scale enabled TrueMotion to focus on what really matters: onboarding more partners and making roads safer.

share this post on