share this post on

discover if a modern data platform is what you need.

get the whitepaper

Our guide aims to answer a simple question: what defines a modern data platform for an insurance company? Decision makers need clear benchmarks to assess their current position and define objectives for their business. This paper provides a practical overview for both business and technical decision

makers.

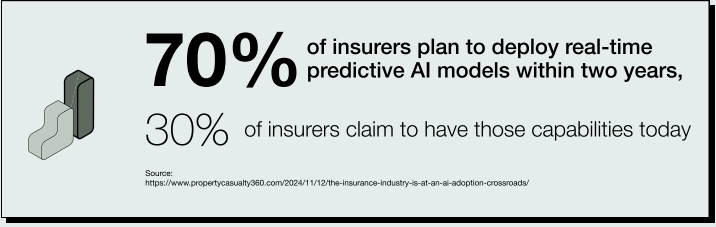

As the AI race becomes everyday reality, decision makers in the insurance industry must prioritize building strong data infrastructure and reliable data platforms. Without a solid foundation, advanced AI projects struggle to deliver value. Effective data platforms simplify access to clean, consistent data, making it easier to integrate AI tools into daily operations. For insurers, this means quicker decisions, better risk management, and improved customer service—key factors for staying competitive.

Data-Driven Excellence in Insurance

- powered by a Modern Data Platform (MDP)

Discover What a Modern Data Platform Can Do for You

In this concise, information-packed whitepaper, we break down: