share this post on

Check out our insurance case studies to find out how we incorporate insurtech into our solutions

Click here to find our case studies

With the world gripped by a global pandemic and financial markets on the cusp of the first major recession for 12 years, it’s fair to say 2020 hasn’t gone the way we expected. Our ways of working have now altered dramatically, and insurers have taken a bad rap over doubts in their coverage caused by COVID-19.

Despite these troubling times, we feel there’s a lot to look forward to in the insurance industry.

While insurance has typically been labelled as an industry that is slow to react to shifting demands and new technologies or other innovations, that doesn’t have to remain the case forever.

The irony isn’t lost that an industry predicated on historical data and a general resistance to change must still look forward and be open to new advancements.

Industry trends and prediction reports come out every year and after reading our fair share, and observing where the world is now, we have compiled our insights on the future of insurtech, and what is required to stay ahead of the curve.

In the interests of keeping this article digestible, we have listed our top five factors for the future and kept them relatively high level. Should you wish to discuss them further with us or any challenges you relate to, you can reach out to us at hello@supercharge.io.

Please also note that we will typically refer to either car insurance providers and neobanks in some of our examples, as these are areas where Supercharge has project experience with.

Despite this, the insights and comments are made to be applicable to other insurance sectors. For the most part, this article is geared towards personal insurance also, but again general principles will apply to certain areas of corporate insurance.

Insurance products have rarely changed over the years and, despite varying products to cover different aspects of our lives, they all follow a very similar formula. Generally, they are structured as year-long policies, with a one-off or monthly payment and cumbersome barriers to change them. They offer very little flexibility in their setup, but all that could be about to change.

With the rise of exciting fintech products, their innovations and flexibility is starting to trickle down to the insurtech space.

Now, we have exciting players like By Miles and Cuvva in the car insurance space primed to provide products that flex as people’s lives change.

They have a technology infrastructure that on the frontend is powered by very user-friendly mobile apps that act as the primary driver for taking out premiums, which makes sense as the next frontier of customer engagement.

What makes their products particularly exciting is that their models are effectively pay-as-you-go. Therefore they are entirely usage-based. This is something many can relate to greatly after this year: with motor travel dropping heavily and travel in general discouraged – many cars have been reduced to a fixture on the kerbside.

Why should we have to pay for a year’s worth of car insurance if it’s just going to sit there all day?

This is where By Miles and Cuvva come in. With slightly different value propositions: By Miles uses telematics either through on-board diagnostics (OBD) devices that plug directly into the vehicle, or a mobile app for connected cars; Cuvva, on the other hand, is still pre-pay but offers temporary insurance; they each offer much more flexible solutions in an industry that hasn’t seen much change since price comparison websites entered the fray in the mid-2000s.

As industry analysts continue to predict that we will move into more of a sharing economy than an owning economy, where society as a whole becomes more comfortable with the idea of temporary on/off solutions, it is these micro-policies that will become ever more prevalent as insurers begin to offer more flexible products, rather than broad-stroke “cover all” options.

There is no better time than now to demonstrate this point. All of a sudden, millions of people were paying for car insurance they were no longer using due to self-isolation.

Of course, insurers have no real incentive to allow users to pause their insurance during this time, but those that offer some kind of flexible service (particularly in the wake of furloughing and job losses) may find themselves looked upon positively in the eyes of the consumer, in an industry that is typically not viewed in the best light.

This kind of functionality will require substantial change on the backend, as well as the frontend customer service side. New policies created to fit this mould will need to be modular in how they’re set up, with clear “basics” and “extras”, along with what can be toggled on and off, as there will naturally have to be a baseline policy in place at all times.

For example, we cannot expect people to completely turn off a policy and then expect to be covered if their car has been broken into. All of this must be served via a customer frontend that is easily accessible and allows for users to dip in and out within minutes.

Mobile apps and responsive websites will serve this very well, but moving forward it could easily become a voice skill if you want to go completely out there.

We enjoy thinking about a future with fun ideas where we say “Hey Google, I’m going driving today” – and then the policy updates.

There are risks to changing the way insurance policies are offered, and we will need to test what is possible, but those insurers who are able to flex in order to meet changing demand towards usage-based insurance may see themselves stay relevant in the future.

Ah, the internet of things. IoT has probably been on more trends lists for longer than any of the other items put together. There’s a lot that can be said that’s already been said, so we’ll try not to retread old ground.

Where IoT can come into its own is in the prediction and prevention of incidents that require insurance claims.

This is a value-add service that enables insurers to become more than brands that are there for us when things go wrong – rather, they actively seek to avoid things going wrong in the first place.

Leak detectors can be installed to help prevent household catastrophes and could arrange for repairs to happen on the household’s behalf (notifying them and asking for permission before taking this action, of course). This would result in automated surveillance over common claim reasons and eliminate the most emotionally charged step of the insurance process – something going wrong.

Sensors and telematics are also nothing new to the everyday person either. Everyone has lived with smoke detectors and many live with burglar alarms, gas detectors and a range of other sensors and deterrents. Introducing additional devices will not adversely affect how people live, but it may help bring them peace of mind.

Working in this way theoretically means fewer claims which can lead to lower premiums, and more customers for those insurers that adopt this - a win-win all -round.

This also enables insurers to roll out real-time underwriting – adjusting policies based on the data gathered from sensors and utilise data gathered from similar devices to deliver real-time price monitoring, exposure risk, predictive alerting as well as up- or cross-selling for additional products or when reinsuring.

This method actually works very well with the prospect of usage-based insurance. With IoT detecting and preventing (or lowering) risk for policyholders, certain aspects of the premium can be toggled automatically to reflect this, resulting in truly personalised products.

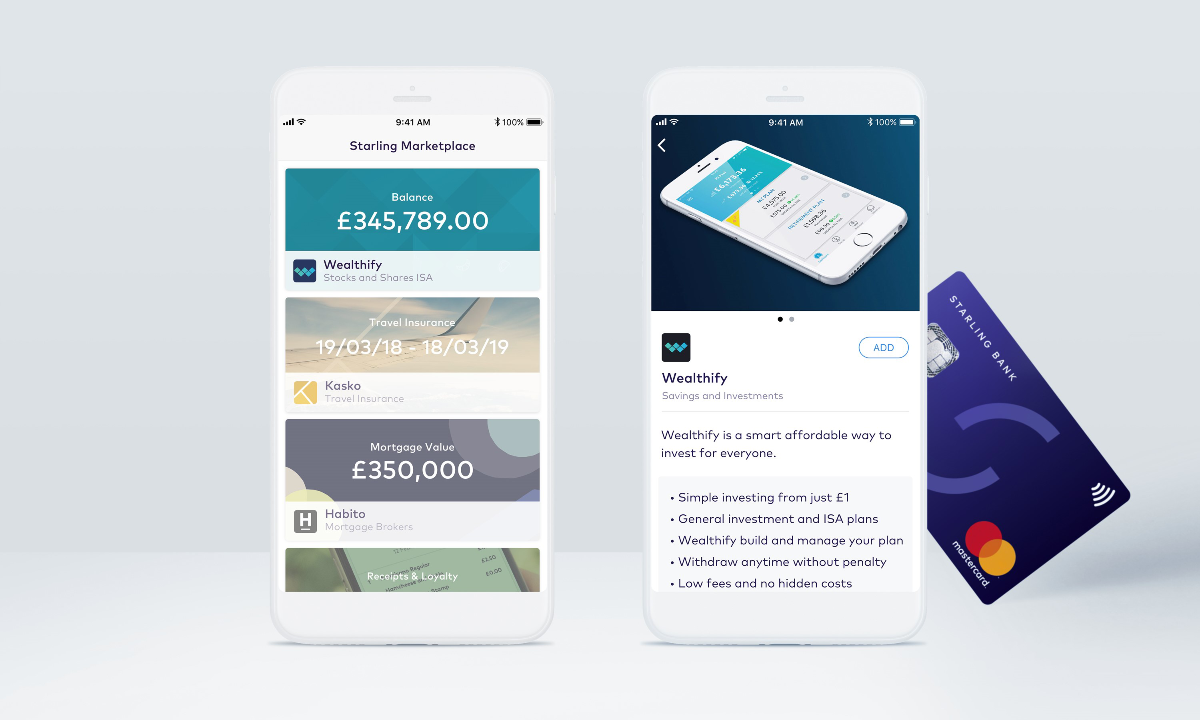

Ecosystems and marketplaces are coming along rather nicely in the fintech space, particularly if you look into areas such as banking, with Starling Bank often cited as the shining example of how to do a marketplace well.

The marketplace enables Starling to offer additional services to its personal and business banking customers, without having to take on the additional financial burden of acquiring or setting up those services itself. This enables other products and services to specialise in what they do best: Starling can continue to specialise in modern banking, and an ecosystem is created as a result for these partners to succeed together.

We liken this system to the analogy of schools of fish. If you compare how they behave, there are several similarities. They are able to react and shift quickly to all manner of threats, whether that is predators or changing tides. They are incredibly nimble and they make a whole that is far greater than the sum of its parts. The approach ultimately helps to assure not just the survival of the individuals but helps them to thrive.

In recent industry trend reports, a lot has been made about mergers and acquisitions. Many insurtech products are coming of age and in a position where their technology, or team, is ready to be picked up by a larger incumbent. However, now we have a new economic recession looming, and with other predictions of another technology bubble about to burst, insurers may err on the side of caution when it comes to bringing in additional capabilities.

An ecosystem approach may be seen as more sensible: we allow the smaller players to continue to specialise and improve their products, while we enable our customers to access them through our insurance products.

This ties in with recently reported trends by Deloitte (“A demanding future – The four trends that define insurance in 2020”) where 62% of insurers believe additional services and non-insurance products to be the most important factors to consumers when choosing an insurer.

Therefore, it could make better financial and commercial sense, at least for now, to focus on providing a platform of products with a group of partners, rather than trying to do everything under one roof.

Similar to IoT, blockchain has been around on many prediction lists. These have already tread the same old ground: the blockchain is able to utilise smart contracts – enabling policies to be issued faster and claims to be settled quicker. Furthermore, it offers a great deal of security and transparency, as all records are individually encrypted and cannot be changed, yet are available to everyone participating on the blockchain.

Through blockchain, many insurance processes can be automated, including setting up a policy, editing that policy and renewing or claiming on that policy.

Where we feel blockchain is particularly exciting is to bring all other trends together and form the backbone of insurance for the foreseeable future. By streamlining the policy creation and editing process, micro-policies will become easy to enable and highly adaptive to the changing needs of millions of customers.

When you combine it with IoT, policies can change rapidly as sensor data returns new information to update the risk profiles of customers, enabling dynamic pricing of policies. In the event of something going wrong, a smart contract can immediately issue the insurance payout, hassle-free, update the policy accordingly and give the customer one less worry to deal with.

The same goes for ecosystems – with every partner participating on the same blockchain, policies are easy to update and manage. It also helps develop the wider adoption of blockchain technology as a whole. As more providers begin to capitalise on its capabilities, others will have no choice but to keep up and do the same.

My final trend is undoubtedly the least ‘trendy’ of them all, as it is one that will never, and should never, go away. If blockchain will be the trend to underpin all other trends, being user-centric is the reason why all other trends exist.

User needs change all the time, at an ever-increasing pace. Our habits and expectations shift as new technologies arrive to change how we work, markets and jobs affect our livelihoods and global disasters disrupt the way in which we go about our daily lives.

It is impossible to predict exactly how customer needs will change, and as insurers cover a wide range of people, each of those will have wildly different needs. What we must do instead is keep a customer-centric culture at the heart of the business and how we deliver products and services.

It is a risk to put yourself out there and define new products that haven’t been tried in the market. But if you have a solid understanding of who your customer is, what their pains are, and test collaboratively with them, you greatly increase your chances of success. It is this approach that has created some of the most successful fintech companies.

The world is currently going through a very difficult time and it is possible that the way we live and work will change when we come out the other side. In the short-term, there isn’t much we can do, nor should do, to launch something or make changes based on what we see right now.

Instead, we must focus on a long-term outlook that puts customer needs and a willingness to innovate and experiment first.

It’s often claimed that the insurance industry is slow to react to trends and new developments and of course there are very good reasons for that. Our business is fundamentally about risk and avoiding it where possible. We face tough regulation. Our marketplace is constantly disrupted by new startups and larger players with deep pockets. Yet, it is challenges like these that cause us to be more creative, more innovative, as we work our way around them and emerge stronger.