share this post on

Check out how we use these factors in our financial projects

Read our case studies

For a while now the Financial Conduct Authority in the UK has been on a drive for investors and wealth managers to show how they add value to the services they provide, to help their end-customers achieve the outcomes they are looking for.

In particular, they are focusing on the core themes of fairness, value and innovation.

For example, in Charles Randell’s speech at the Investment Association annual dinner last October, Randell stated that pensions suffer from weak governance and limited consideration of its holders when it comes to values, fees and charges, so the FCA will be considering how governance in this area can be tightened up.

Another key point he raised towards the end of his speech was the importance of regulation in its role as a competitive advantage to the UK investment industry, without putting the interests of the sector ahead of the people it’s here to serve.

In other words, the regulator, and the investment industry as a whole, must never lose sight of what this is for: the end customers.

So, just how can investors and wealth management companies ensure they prove their value to end customers, be fair in their fees and processes, and innovate to go further in what they deliver while staying compliant and preserving the bottom line? Further, how can they do this with the backing of the regulators to mitigate the risk of falling foul of legislation?

These are tricky questions everyone struggles with and depending on your customer, there is no one-size-fits-all approach. Rather, you will likely aim to be stronger in some areas while compromising in others, based on your own business principles, goals and target customer needs.

In most cases when our team speaks to people looking to invest their money during our fintech projects, there seems to be a core group of stand-out reasons why one person may choose a certain wealth manager or investment platform over another.

While, in truth, the reasons are nuanced and as diverse as their financial journeys, it makes sense to look at these key areas as a starting point, and why they offer value to the end customer. These are:

Now we know the key factors that weigh behind most people’s decision-making process, we can start to drill down into why they matter and potential ways they can be used to drive more value for them and therefore, improving your business model.

There’s a reason we’re starting with fees first. Across the podcasts we listen to, the books we read, the people we speak with and the online groups we follow, the common denominator across all recommendations is fees.

In terms of a blanket, “I don’t know your personal financial situation but I’m going to tell you what is best anyway”, paying the lowest fees is generally the number one reason for selecting a provider.

We’re sure this comes as no surprise, and when we looked into this further it makes complete sense.

The main reason a customer is seeking an investment platform or wealth manager is one thing: to grow their financial assets. Whichever way this is achieved the fastest while keeping the same risk profile is generally going to come out on top.

The two largest hindrances to portfolio growth over time (besides customer emotion/behaviour and market downturns) is inflation and fees. Now, inflation isn’t something we can do much about, but if we use the Bank of England’s 2% target inflation rate (and at the time of writing it is 0.8%) on a portfolio growing 7% annually, then the real return is cut to 5%.

If a wealth provider charges, say, 1.5% for all their fees inclusive, then this real return is actually 3.5%. Suddenly, the real return is actually half the market return. On a £250,000 portfolio, that is a difference of nearly £150,000 over 10 years.

The champion in the fees space, and by virtue of this the most recommended platform, is Vanguard. Their 0.22% annual fee (their lowest-cost product at the time of writing based on their account management fee and other costs) means the real return on that same portfolio above is nearly £50,000 greater than the 1.5% portfolio. That’s an additional 20% boost on the original £250,000, so it becomes easy to see why Vanguard is often the provider of choice.

Unfortunately, fees aren’t something we can easily control. After all, it comes down to the costs to manage the service, costs of trading, general business operating costs and ensuring the business is profitable.

Utilising artificial intelligence and automating manual processes, or fine-tuning an algorithm to make investment decisions, is often cited as a way to reduce costs and pass those savings onto the customers, but even platforms like Nutmeg who themselves are considered low cost cannot come close at a total annual cost of 0.68%.

Therefore, if you can’t directly compete on costs, can you at least bring them to a level that makes them more palatable in the face of these more digitised providers? What else can you do to influence their decision? Can you improve the quality of your product and customer experience to make the additional fees worth paying?

We’re sure you don’t need us to tell you that, from an outsider’s perspective, the investment world is a confusing place of percentages and acronyms. Let us now introduce you to Hick’s Law.

Hick’s Law states that the more choices a customer is presented with, the less likely they are to even make a choice.

There are countless wealth management providers available to UK investors; how are they possibly supposed to choose just one? Not only that, but when you add ISA, LISA, JISA, pension, and general investment categories, then risk profiles, market types and many other variables, it becomes incredibly difficult to identify which one is right.

Due to Hick’s Law, this leads to a strong chance that someone will not make a decision at all and stick with the status quo. After all, how many times have we heard stories of people leaving all their savings in a current account, a matured easy access saver or, dare we say it, under the mattress?

While the number of products you provide is a commercial decision that is difficult to control, we can all do our bit to simplify the offerings and choices available to help prospective customers reach an informed decision.

For example, could you group your products into easy-to-understand categories that give a high-level profile at a glance? Could you walk your customer through a short wizard to identify what could be right for them? This could be based on goals, risk aversion, timeframe, or even personal interest (such as tech, eco-friendly or socially conscious funds).

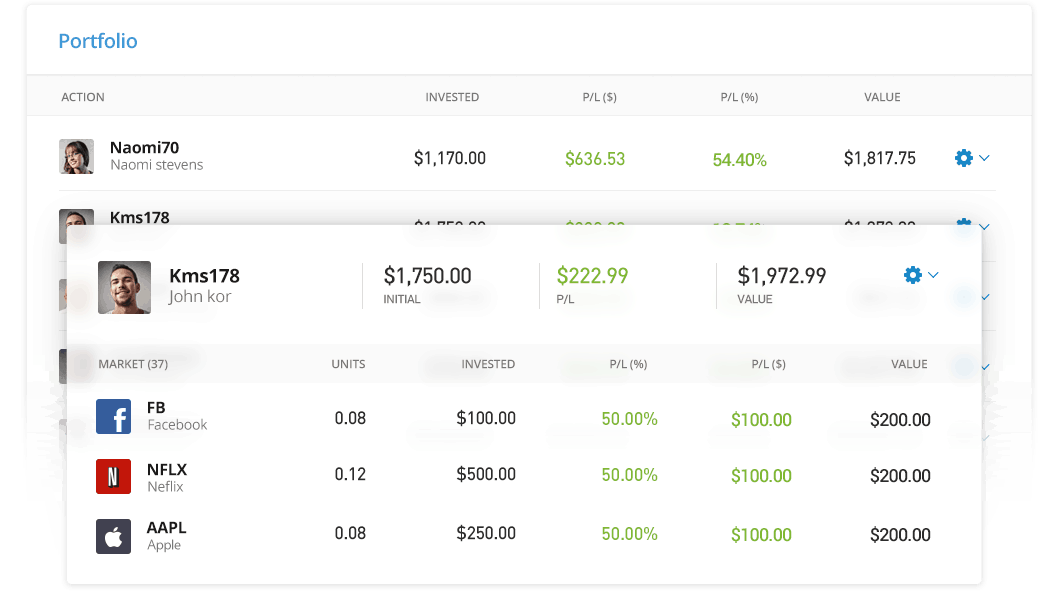

eToro utilises an interesting concept based on social proof to encourage new users to invest. They show new investors a list of the top-performing users on the platform, then provide the new user with a button to ‘copy’ every action of that top investor.

Suddenly, all decision-making has been removed from the equation, and the user can begin automatically investing in the same funds as others who have performed well.

By thinking about your various funds like this, you can save cognitive overhead from the user trying to process everything, by showing them the key purpose of each category of funds.

This can funnel them into products better suited for them, which they will continue to filter until landing on the right one. Furthermore, this helps them buy into the process early, and over time as they continue to learn more and get comfortable with investing, they can start to refine their portfolios in more complex and sophisticated ways.

Technology is an interesting point to make, as ultimately customers do not care what technology you use. They will not notice if the technology works well, displays the relevant information (such as prices and values) and transactions are completed fast, unless something goes wrong.

Our habits and expectations also shift as new technologies arrive to change how we work and go about our day-to-day. Therefore, it is the user experience of the product that becomes an important factor.

If a product has a straight-forward, intuitive onboarding and KYC process, that immediately tackles one of the biggest barriers to investing.

If the customer is then able to understand how their portfolio is performing in a fast and simple way and move their money around as required without being held back by the technology, then they are far more likely to continue with the service, even during periods of low performance.

As mentioned before, the way we use technology constantly changes, and the way we manage our money and portfolios may change in the future too, particularly as new devices break into the market that provide new channels for us to engage with our customers.

The process to deliver a better experience for every user is an ongoing and challenging journey. Therefore, user experience, technology and innovation become more of a culture rather than a firm end goal.

So with that, it is important to constantly monitor the technology requirements of your customers and how they will access your services in future. A lot is still being made about mobile-based investing and that likely won’t change for several years at least, so now it’s specifically how you use apps and smartphones that will make the difference.

Knowledge of the latest operating system features, physical hardware and software standards is key to staying ahead of the curve, yet this is a huge challenge for many wealth managers. It is fair enough to focus on your core product or service and make that the best it can be – after all, you are the specialists in wealth management.

Therefore, the best option may be to hire a person or team, either external or internal, to run the tech that enables you to work on what you do best and ultimately deliver better value to your customers.

At the end of the day, if you can launch digital products based on a solid understanding of who your customers are, what challenges they face and the goals they have, you can greatly increase your chances of success by working and testing collaboratively with them.

This simple, yet difficult to master, approach is the reason why many fintechs succeed today.

This is arguably why most customers choose to leave a firm. There can be a variety of reasons behind this, such as a lack of transparency, inability to resolve issues, inappropriate communication (like sales calls at dinner time), or a support team member not being available in the way the customer requires. The flipside of this, however, and the opportunity, is that there are many ways to do customer service amazingly well.

Delivering great customer service is a way of distinguishing yourself in a way that is removed from the core product, but more important is how people can access your customer service team. Rather than see customers’ frustration or pain as a threat to the business, it is important to identify the opportunities that are possible by excelling in your response to the issue.

The first factor many consider when receiving customer service is service availability. Where can a customer speak to the team? Is either in-app chat or some kind of live chat service available?

Chatbots can also be a great way to automate common requests and those scripts can be used across a variety of platforms, including voice assistants.

Of course, it’s unlikely someone will use a voice assistant to get support, but it’s by taking this flexible, channel-agnostic approach that will help you to tailor and optimise the service you provide across all channels.

Naturally, the staples of contact forms, FAQs, email and phone support will still exist, but even these can be carefully considered to deliver the best support possible. For example, searchable FAQs, dynamic forms that detect potential responses as a user writes their message, and intuitive call routing (with voice and keypad options please!) all go a long way too.

By providing this wide array of touchpoints, you’re enabling dozens of ways for you to communicate your brand personality, values and show you’re doing everything you can to help your customers reach their end goal, ultimately reminding customers of why they chose to trust you with their financial futures in the first place.

Delivering an outstanding service naturally goes beyond how you behave when things go wrong, but if you start from the lowest possible points in the customer journey and work your way up from there, you can progress your customers from simply being customers, to becoming brand advocates, recommending your service to others in their circles and boosting your long-term top-line.

Protection is an interesting aspect to consider, and not so much of a competitive advantage when the majority of providers are covered under the Financial Services Compensation Scheme, covering individuals’ assets within a firm up to £85,000.

If this is the case, then why is protection a factor? The short answer is, it isn’t a factor until it’s not there.

While it’s fantastic to see many firms or products are FSCS protected, there are still some products out there that are not covered by this.

If anything, protection can be what turns prospective customers away from a product. Recently, we saw adverts for Zeux, who in January launched a somewhat controversial savings account promising incredibly high 5% returns. This is at least a couple of percentage points above what most savings accounts offer from incumbent banks, and even in the investment space a more conservative individual may accept 5% returns with no risk on capital.

Most people, naturally, would ask where the catch is, and in this case there seems to be a pretty large one, depending on your appetite to risk. The savings seem to be backed by cryptoassets, which are incredibly volatile and businesses in this space are very unstable. Furthermore, those savings are not protected under the FSCS, so all savings are at risk if Zeux does not succeed. For some, this can be enough to turn them off despite the promise of high returns.

In these turbulent times for investors, many are likely to lose heart in their savings and investments during an extended period of volatility. We can’t rely on them making the logical choice of keeping their money stored away for the long-term, nor can we easily convince new customers to allocate their money into our funds.

As such, being clear on your value proposition and demonstrating your ability to innovate in adverse times for the benefit of the customer will help set you apart and put fears at ease.

And when things go back to normal, people will remember the companies that actively did whatever they could to support them through the tough times and continued to create positive experiences, while avoiding those that stayed operating within themselves, not offering new or adapted solutions to the challenges customers are now facing.

Ultimately, when investors are looking at wealth managers, they are not just looking for value; they are also looking for someone to trust.

The factors listed above do not only affect the perceived value of your service, but they also have an impact on the level of trust a customer is willing to place on you.

You build trust in the same way you create value too. The user experience and technology has to be simple enough for your customers to navigate through your product. The professionalism of user interface, frontend, animations and wording all signal the level of competence a company bears, and they all build up the image of how trustworthy a company is.

The product has to be available and reliable too. Your customer service must be equipped to resolve issues early and feel empowered to do right by the customer. Finally, protecting their money and keeping it secure, not just for regulation, but against criminal activity too, is a major factor of building trust.

So, as you continue your journey to add value for your customers, also consider what you can do to level up your trust factor. In many cases, the two factors are linked, each resulting in a stronger service proposition for your brand and a stronger position in a market becoming increasingly disrupted by new digital players.