share this post on

this article is part of our Prevention tech in insurance whitepaper

Compared to personal insurance lines, the higher costs and damages from commercial claims increase the need for prevention services. Commercial losses can be more widespread and impact a wider range of people, including customers, business partners, supply chains, and stakeholders. As a result, executives bring a different approach to insurance and risk prevention for their companies, making investments in risk prevention services more attractive and necessary.

In this article, we will highlight three inspiring prevention offerings on the commercial insurance market and also introduce our prevention maturity model for this domain.

Insurers can now use improved network connectivity to understand policyholders' risks more effectively, both before and during the policy period. They can also use prevention technology to develop closer relationships with their commercial policyholders and increase their relevance.

IoT enables real time monitoring of assets and allows for predictive maintenance, avoiding claims altogether. As the insurance industry evolves, it is becoming increasingly important for commercial insurers to broaden service offerings and leverage technology and data to actively prevent losses for insureds.

While traditional insurance companies may choose to partner with tech or insurtech companies to add these services, the most successful insurers of the future will be those that are able to effectively integrate prevention services into their core offerings. By proactively addressing risks and helping policyholders prevent losses, commercial insurers can not only improve their bottom line, but also build stronger, more loyal relationships with their customers.

There are many types of commercial insurance available, each with its own focus on prevention depending on the industry it serves. In this section, we will introduce three interesting Commercial Insurance products from a range of industries that have different levels of emphasis on prevention.

San Francisco-based Anzen is a leading provider of executive risk insurance. The unique tools they offer help corporations identify and proactively limit their management risk. Andreessen Horowitz saw the growth potential in the insurtech startup and its prevention services and funded Anzen with $10 million in November 2022. (1)

Anzen mainly specializes in Directors and Officers insurance (D&O) and Employment Practices Liability (EPL) insurance. D&O is designed for companies to protect their executives and management from claims arising from their actions. It typically covers financial losses and legal fees in case the insured is held liable. In certain cases companies can be legally required to obtain D&O insurance.

EPL offers protection against claims associated with employment processes. Common EPL claims include wrongful termination, breach of contract, or similar claims from employees (or former employees) who believe they have been mistreated by their employer.

Employment law firms, litigators, and consultancies have a huge market for helping companies with employee disputes, worth around $23 billion in the US alone. (2) Most companies want to avoid the financial and reputational harm and inconvenience of employee disputes. Anzen's Management Operations software helps them do just that.

Anzen's Management Operations tool is a good example of how commercial insurtech companies can utilize readily available data to enhance their offerings with preventative services.

Traditional D&O and EPL insurance only provide reactive coverage and are not customized to the specific needs of a company. Anzen offers the first proactive solution to reduce the risk of employment practices disputes by giving all policyholders immediate access to its Management Operations software. With MgmtOps, companies can proactively address potential issues and prevent disputes from arising.

MgmtOps is a risk management platform that helps companies manage corporate governance, compliance, and document retention. It connects to the insured company's HR systems and other people operations tools, such as payroll portals, e-signatures, and background checking software, to identify audit or compliance risks. It can be easily integrated with systems like Gusto, Lever, and Workday to provide data for the platform.

In short, MgmtOps is an automated compliance system that helps prevent employee, compliance, and operational risks from causing serious damage.

The platform securely integrates into a company’s core HR and PeopleOps systems and finds gaps in employee compliance and other potential risks for the business and its employees.

These risks can include:

This information is generally already available for the insured businesses, but not in a single place and without emphasis on looking for red flags and gaps. MgmtOps is especially useful for small, fast-growing companies that may not have mature HR and compliance departments and processes in place.

In addition to providing valuable insights, MgmtOps also offers recommended behavior training for employees to reduce the risk of workplace harassment and other misconduct.

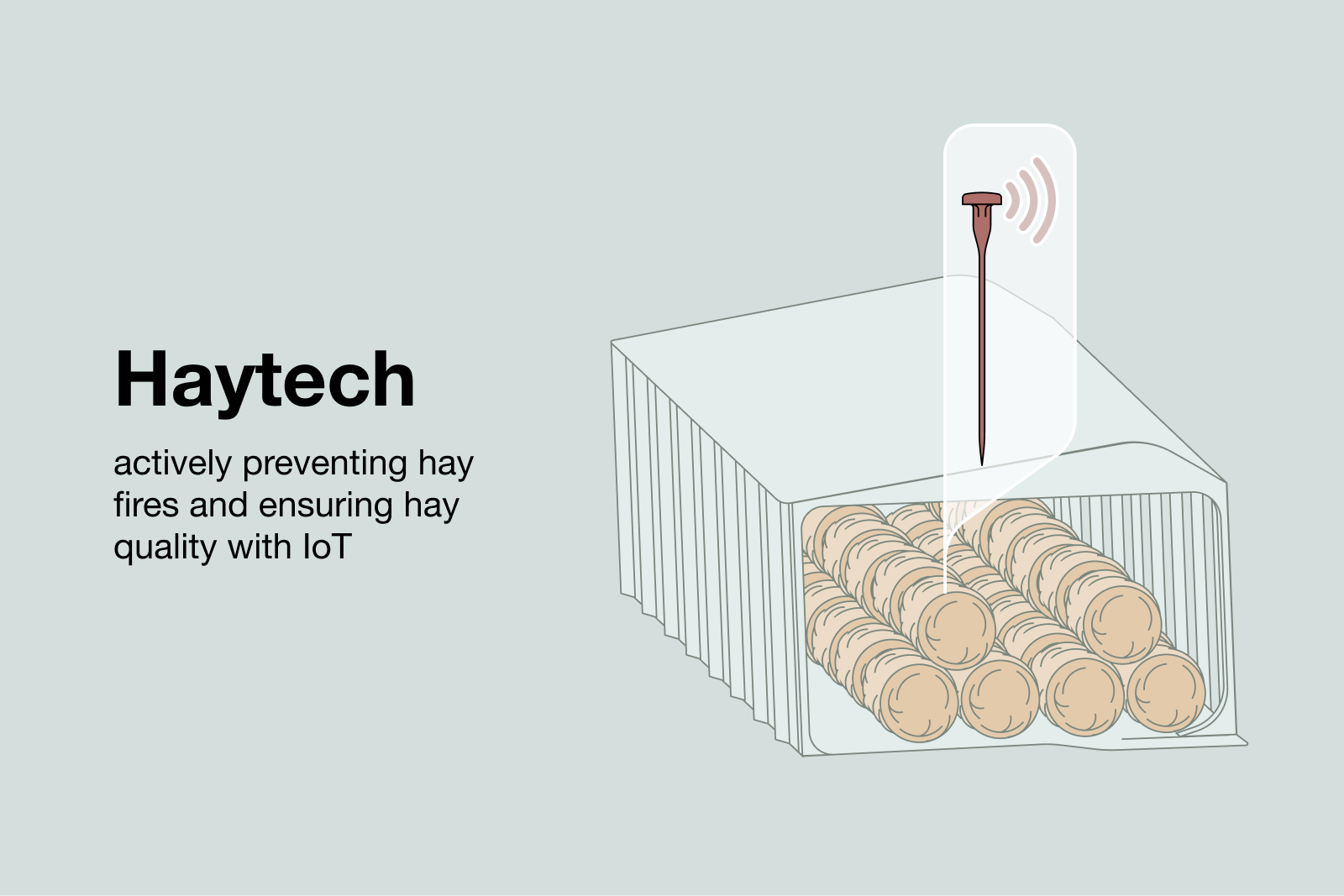

Nationwide has teamed up with Quanturi, a Finnish tech company specializing in IoT devices for agriculture, to implement HAYTECH, a wireless hay monitoring system that helps prevent agricultural losses in the US.

In addition to offering insurance protection against fire hazards, HAYTECH aims to improve farm safety and prevent fires from occurring in the first place. Although Quanturi offers other products as well, in this paper we will only touch on its wireless hay monitoring system, HAYTECH.

Fires can be devastating for farmers, causing millions of dollars in damages to hay, barns, and other structures, as well as lost revenues and increased insurance premiums. A single overheated bale of hay can ignite and destroy an entire storage facility, potentially damaging neighboring buildings as well. The financial impact of a fire can be catastrophic for a farming business, making insurance protection critical.

Proper storage practices can significantly reduce the risk of hay fires. Temperature monitoring is key to preventing fires and issues caused by suboptimal temperatures. HAYTECH provides real-time monitoring and an early warning system to alert customers of potential issues before they can cause significant damages.

To use HAYTECH, customers install a series of easy-to-spot and reusable probes into their operation’s hay bales and stacks, and these probes will regularly transmit temperature data to the cloud and send SMS alerts when temperature rises above a previously set threshold. Nationwide’s commercial policyholders who leverage the Quanturi’s system can benefit from:

HAYTECH's sensor probes are the key components of the system. These reusable probes measure hay temperature and transmit the data to the Repeater, which is located inside or nearby the hay storage.

For maximum safety, it is recommended to place a probe in every bale, but even monitoring a portion of the haystack provides increased security compared to manual temperature sampling. The starter pack includes 10 probes, and additional probes can be purchased as needed.

The Repeater is an additional security measure to ensure proper signal transmission between the probes and the base station, and it is situated in or near the hay storage area. The Repeater device gathers measurement data and wirelessly sends it to the HAYTECH base station.

The Base Station is connected to the internet and receives measurement data from the Repeater, sending it every hour to the Quanturi.app service to analyze the raw data. In case of overheating, measurements are passed immediately so warning and alert messages can be dispatched with no delay.

Quanturi.app is the online service that visualizes measurement data from probes. This web application provides an instant overview of HAYTECH probes and their temperature levels. Users can set temperature thresholds for SMS triggers or warnings. Easy to understand data visualization enables farmers to follow a probe’s’ temperature history and spot problematic increases that would ruin the hay or cause fire.

Data-driven insurance solutions like HAYTECH are revolutionizing the agriculture industry by providing technology-enabled opportunities to actively limit risks and prevent damages.

HAYTECH's early warning system helps farmers detect dangerous temperature levels in hay bales, but the system has the potential to do even more. By leveraging HAYTECH's historical data and trends, farmers can proactively create safer storage environments and become more aware of common risk factors that contribute to fires.

There are about 2.6 million nonfatal workplace accidents and injuries within US private businesses each year. (3) The cost of occupational hazard is clearly not just a monetary one. Companies need to do absolutely everything in their capacity to reduce the risk of employees getting hurt while performing their work.

Workers’ compensation coverage is mandatory and there are different work safety regulations which employers need to adhere to. However, it is still evident that factories and other hazardous workplaces can do more with the help of cutting-edge technology to protect workers day to day.

The partnership between Intenseye and AXA XL holds particular promise for the manufacturing industry, offering unique benefits for manufacturers, leveraging highly interconnected know-how on Employee Health and Safety (EHS) and insurance. Intenseye is an EHS software platform that helps enterprises scale employee health and safety across facilities.

Using the latest breakthroughs in computer vision, Intenseye empowers EHS teams to monitor facilities 24/7, receive real-time violation notifications, and operationalize their rapid response procedures. At its heart it is an AI powered workplace safety platform.

Intenseye’s software can identify health and safety violations, from not wearing a hard hat to unattended objects left in the pathway of a forklift and many more by analyzing video footage from already existing network connected cameras. Intenseye anonymizes individuals in footage, so they are not recognizable at all, avoiding privacy concerns and ensuring employees that they are not getting penalized for safety violations.

The algorithm can identify 40+ different unsafe behaviors which are the most common within workplaces. As a result, the system serves three purposes for workplace safety: prevention of accidents, rapid response in the event of an incident and emergency, and proper understanding of unsafe acts and conditions in the workplace.

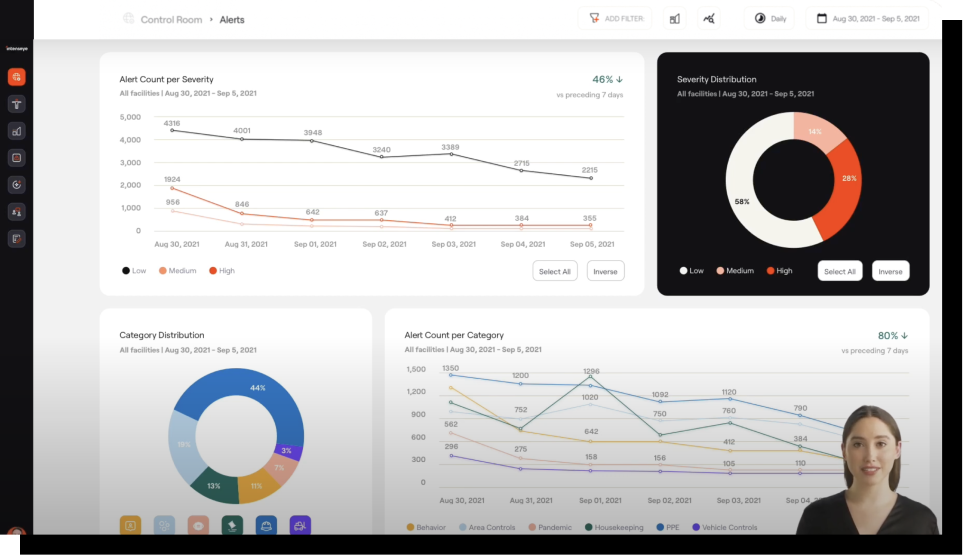

Workplace supervisors get access to an EHS dashboard which incorporates federal and local workplace safety laws, as well as individual organizational rules to monitor worker safety in real time. All told, users of the Intenseye platform can select from the 40+ different unsafe behaviors and customize cameras to actively look for them. When a violation occurs and is spotted, EHS professionals receive an alert immediately, by text or email, to resolve the issue.

Intenseye also takes the aggregate of workplace safety compliance within a facility to generate a compliance score and diagnose problem areas. The EHS dashboard can help to uncover real trends of unsafe acts or even physical areas of concern where professionals need to pay extra attention. To improve something its results must be measured: Intenseye provides the option to set up KPIs to measure and monitor progress on workplace health and safety, to check how effective some preventative actions were.

With the help of the EHS platform it is possible for employers to greatly reduce their risk exposure to workplace accidents. Intenseye demonstrates how smart technology can quantify and reduce risks in seemingly unpredictable and complex environments like human behavior within the workplace.

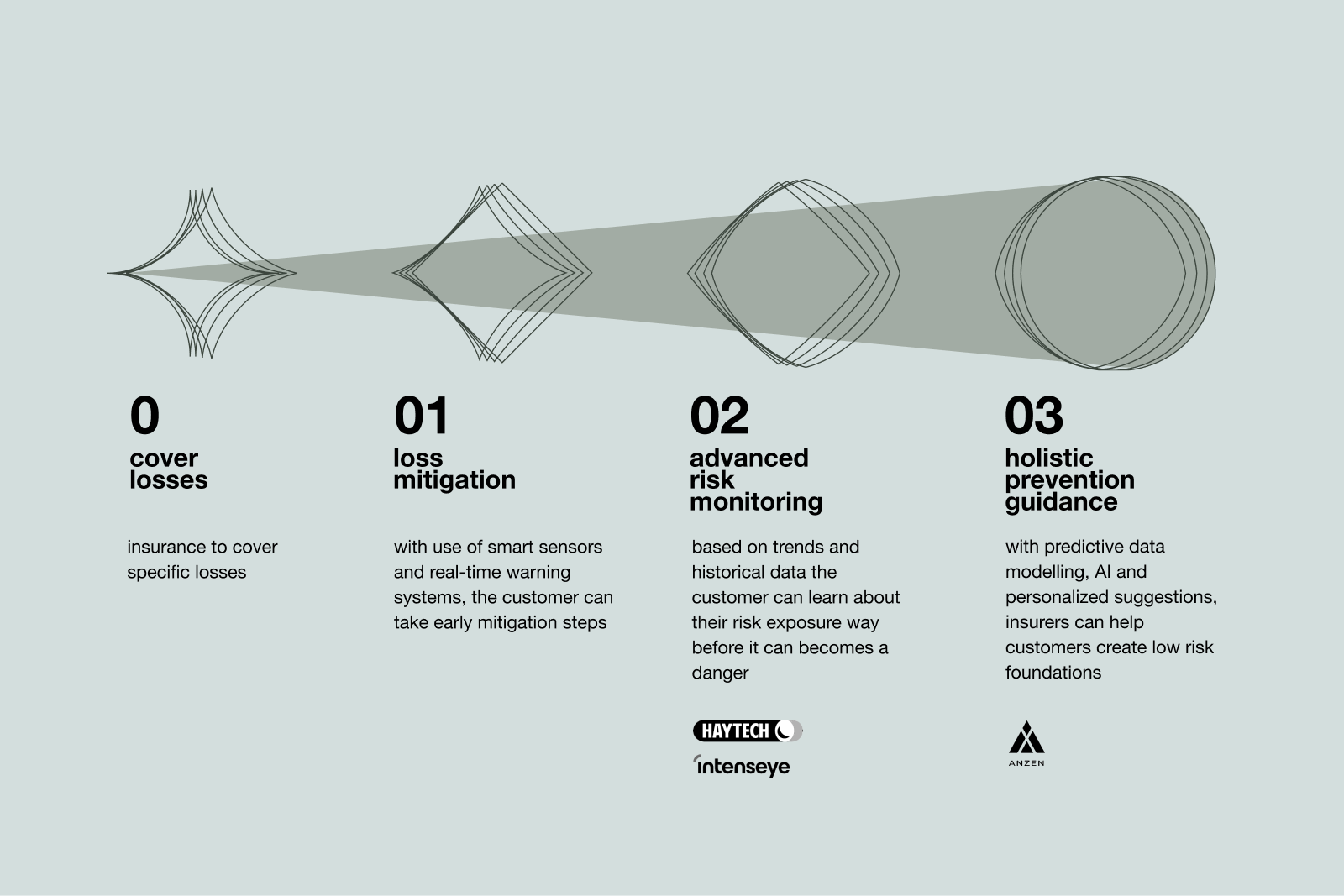

We categorized commercial insurance programs into four levels depending on their prevention maturity.

Starting at Level 0 with basic coverage for specific losses, the model advances to Level 1, where loss mitigation is facilitated through smart sensors and real-time warning systems.

At Level 2, advanced risk monitoring utilizes trends and historical data to provide customers with early insights into their risk exposure.

Finally, Level 3 introduces holistic prevention guidance, leveraging predictive data modeling, artificial intelligence, and personalized suggestions to assist customers in becoming fundamentally low risk.