share this post on

this article is part of our Prevention tech in insurance whitepaper

For most people, their home is more than just the largest asset they’ll ever own; it’s the focal point of their family life and the foundation of feeling secure. Prevention tech for homes goes beyond protecting losses and creates opportunities to make homes safer altogether.

In this article, we explore various aspects of prevention technology in property insurance, examining existing examples and industry practices, including the innovative use of smart home devices.

The adoption curve of smart home devices is passing from early adopters to the early majority. In 2022, between 45-70% of US households will use at least one smart home device. This reported range is so wide because there isn’t a standard definition of what counts as a smart home device.

Growth is fueled by devices becoming more useful, less expensive, and easier to set up. At the same time, consumers are more aware of the value they can unlock. 45 - 70% sounds like a lot - but we’re still in the early stages of connected homes. Only 11% of consumers have three or more connected devices in their homes, and most only own affordable and easy-to-install devices such as smart speakers and connected doorbells, rather than more advanced solutions that significantly improve home comfort or security.

The connected home landscape is rapidly evolving and lacks an established hierarchy between larger and smaller providers. Providers bring a range of visions, strategies, and technologies, leading to a diverse and competitive market.

Smaller startups and manufacturers focus on capturing a niche audience and partnering with hub applications. Larger companies like Samsung, Apple, Google, Amazon, and IKEA, on the other hand, aim to be the primary entry point into the digital home. These companies come from a variety of backgrounds, from cloud computing to furniture manufacturing, and their diverse experiences shape their ideas about the future of the connected home.

Competition is usually good for consumers, but in the case of smart home devices, the lack of wide interoperability and universally accepted tech standards also leads to a fragmented user experience and ultimately hurts adoption.

Today’s lack of interoperability makes it difficult for customers to build their own digital home ecosystem - as few companies are tying physical and digital into seamless, end-to-end journeys. Companies know this, and there are signs that they are converging on common communication interfaces - such as the Matter project.

Smart Speakers (think Amazon Echo): Some research methods exclude these when surveying smart home device adoption as they are often exclusively used for playing music but their manufacturers generally have more grandiose plans: to have these devices (and the underlying cloud-based software) serve as the main voice interface and intelligent personal assistant that orchestrates all smart devices in a home.

Home infrastructure: Devices that make the core infrastructure of the home more convenient, easier to monitor, or safer. Prominent examples are:

Home appliances: Connected appliances that allow for remote operation and monitoring and try to make life easier through intelligent automation. Think of smart fridges and connected coffee makers.

Home Security: Solutions that protect against malicious actions threatening our home:

The Insurers’ role in the smart home trend

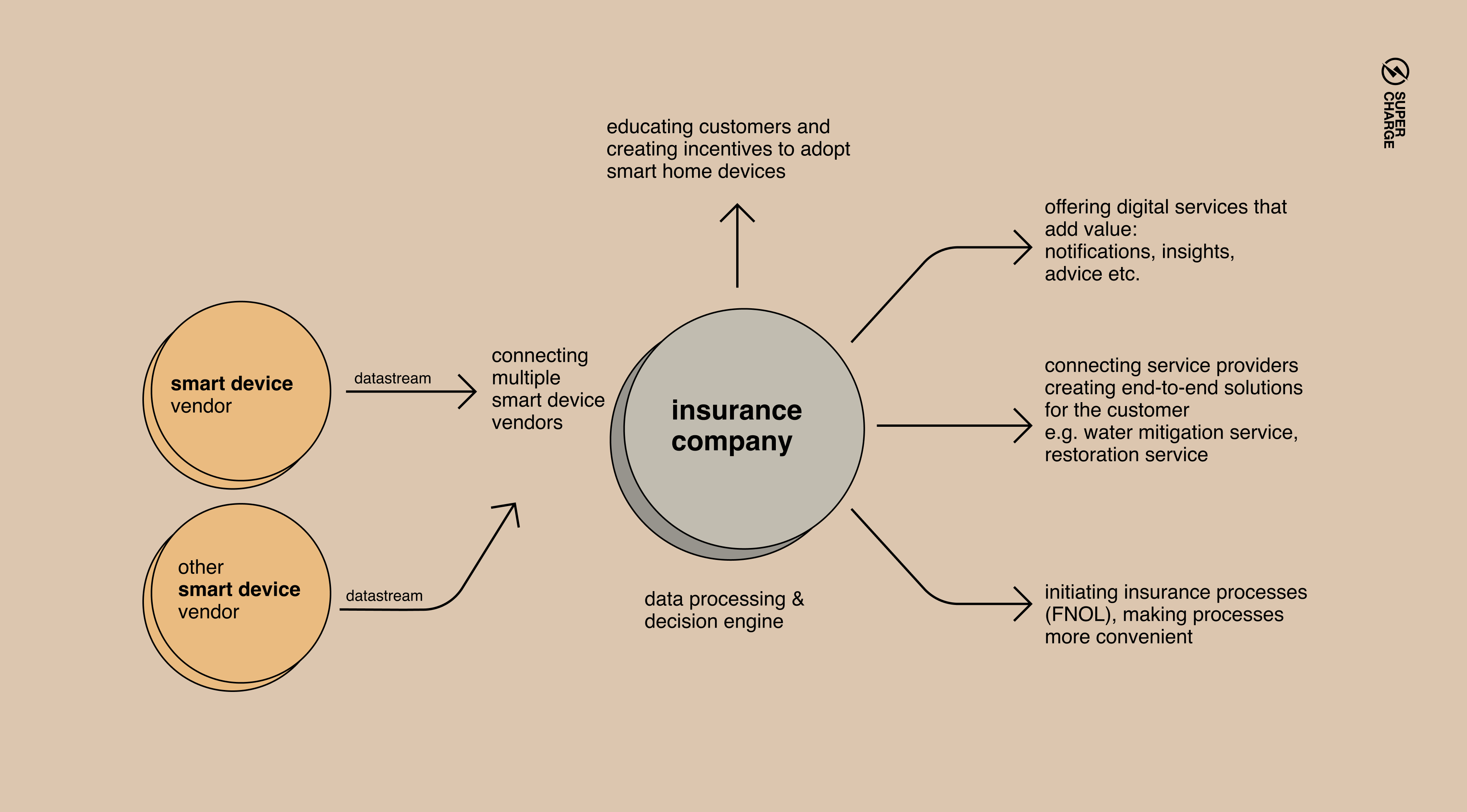

Insurers can play a key role in promoting the use of smart devices and creating a cohesive ecosystem of connected devices and services for their customers to help prevent harm. Gaps in service, disrupted customer journeys, and hesitant customers all present opportunities for insurers to add value. Ultimately, customers are looking for practical solutions that make their lives easier and safer, rather than flashy gadgets.

It makes sense that insurers focus on the home safety and security aspect of the smart home market, rather than the comfort and entertainment segment, where their brands aren't as naturally suited.

Smart home devices are all about real-time data collection and processing, which resonates perfectly with new data-driven models that most carriers envision as their future. Also, just as we laid out in the foreword, they offer great opportunities to fundamentally transform how the insurer and its brand are perceived.

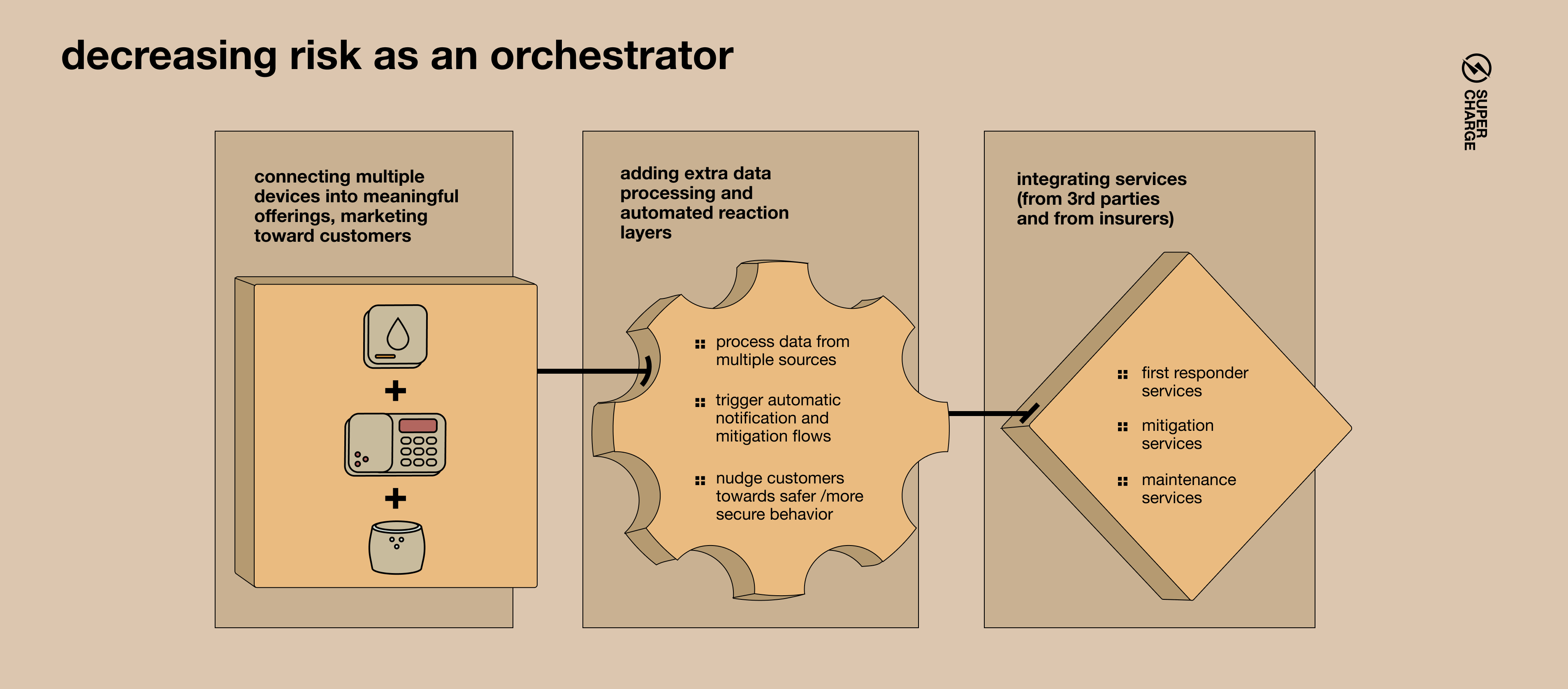

Even tech-forward carriers stay away from producing and operating connected devices, and instead look for specialized partners to handle that part of the equation. This makes sense financially and from an innovation risk management perspective and lets insurers focus on processing data and building value-add services.

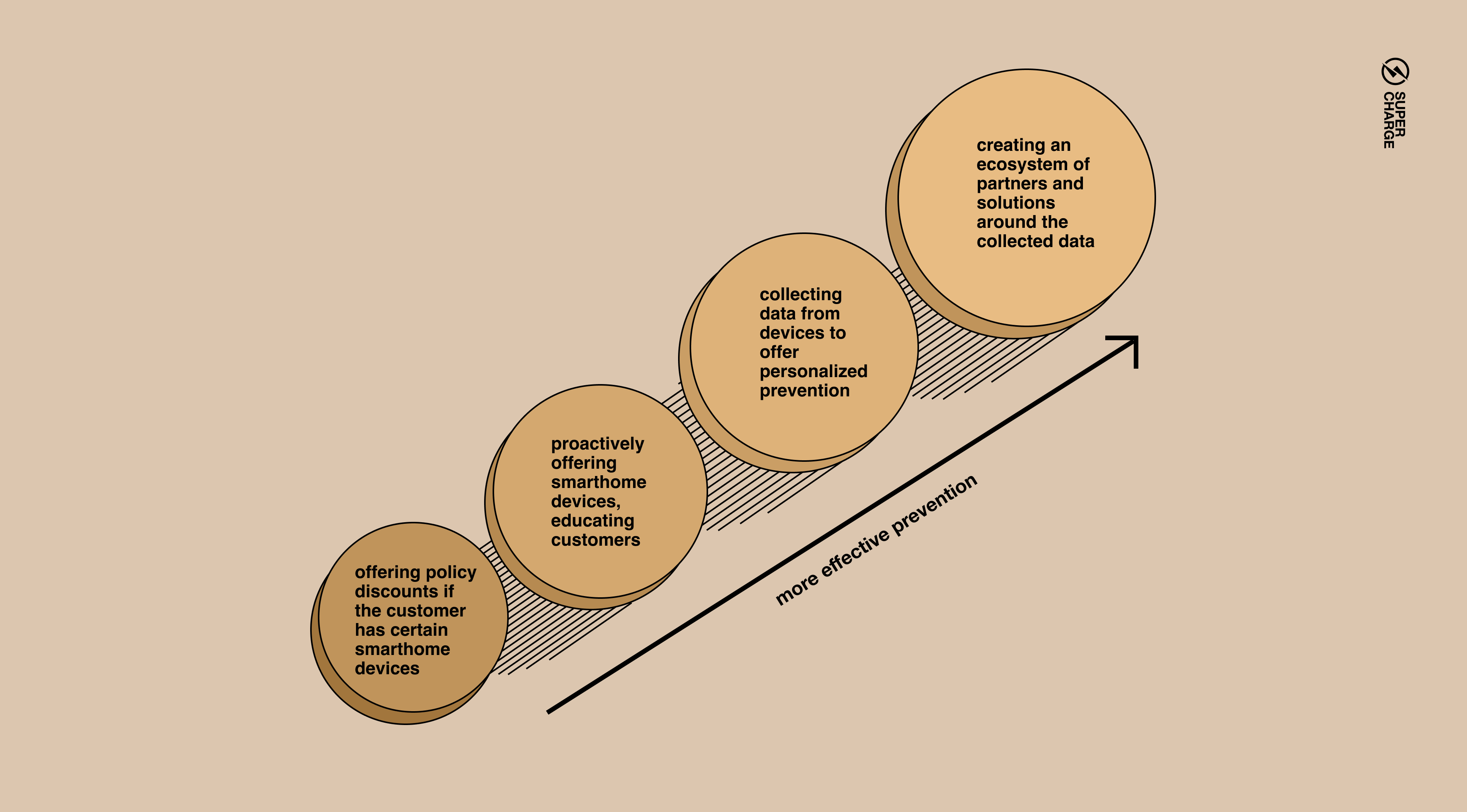

Most insurers have modest goals and simply promote smart home devices without processing any data themselves. Almost all large P&C carriers offer some level of UBI in Auto Insurance, but for homeowners policies, most offerings superficially focus on simple discounts on premiums and/or devices.

From an immediate ROI perspective this makes sense for now: while it is plain to see how UBI programs enable transformative pricing and risk models, the smart home tech just isn’t quite there yet. Or rather, the tech needed for a similar effect is much more diverse, expensive and complex.

But being cautious carries its own risk. Playing it safe keeps carriers out of the learning, experimentation, and organizational muscle memory needed to gain a first mover advantage with maturing tech.

Innovation by definition involves risk - some initiatives will succeed while others fall flat. American Family experimented with smart home devices and even created a demonstration home to test products with customers. One of their initiatives, Hedge Protect, was discontinued this year. However, their other investments, such as leading the Series B round for the successful smart doorbell startup Ring (now owned by Amazon), were more successful.

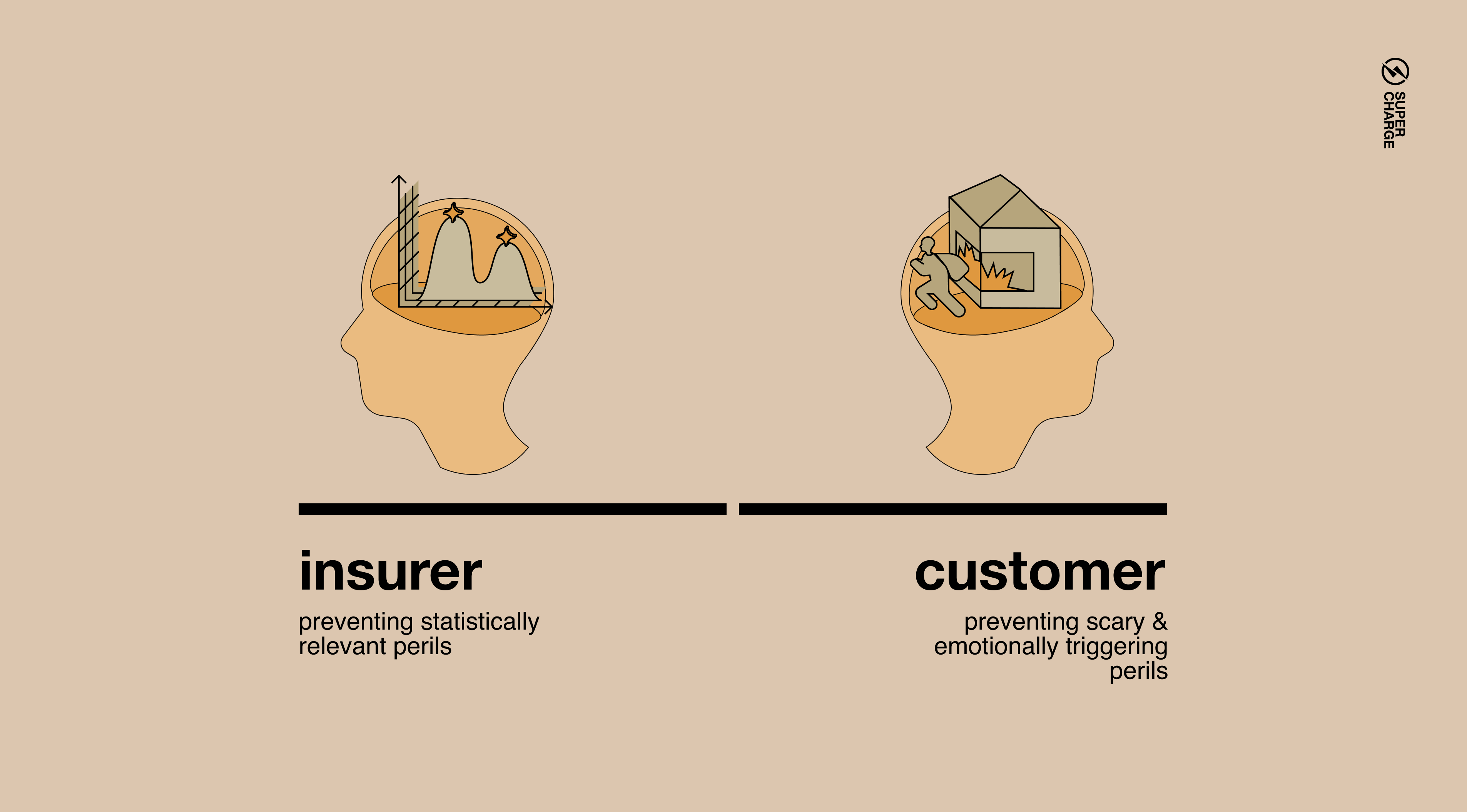

There is a challenge in getting the specific IoT devices that can significantly impact risk models into customers' homes: human behavior. Behavioral economics show that individuals do not always make the rational choice and that emotional components influence most customer decisions. Looking at statistics, it's easy to identify devices that effectively reduce frequent risks. However, these risks aren't the most frightening ones for most. For example, water leaks are one of the most common home damages, but only 35% of homeowners consider them a major threat.

Smart home devices that focus on safety and security, such as fire detectors and cameras, are the easiest to sell because they prevent threats that are particularly frightening or undermine people's sense of security. As rational actors, insurers must educate customers and offer incentives that encourage adopting devices that significantly improve the safety of their property.

VYRD is a new entrant to the Florida homeowner’s insurance market - the first Florida-domiciled P&C insurer licensed in the state in over three years. VYRD combines using technology to prevent and mitigate risk and having a team with specialized local experience and insights to navigate Florida’s uniquely difficult market. On top of the increasing intensity of hurricanes, high incidents of fraud and high operating costs have stifled business - causing Property Insurance companies to cancel policies, leave the state, and liquidate at an increasing pace.

VYRD believes that by being selective about what homes they want to insure and having the right policy structure, they can thrive and fill the supply gap in the market. Besides being smart about their underwriting practices, VYRD bets on prevention tech to decrease the impact of non-cat perils.

Water and wind/hail are the most frequent sources of non-cat claims. While fire and lightning usually result in more severe claims, they occur much less regularly. There is a lot of interest in using digital solutions to prevent wind-related damages, but the tech for water-related risks is further along. The idea itself is not new: many companies on the market offer leak sensors, pipe-freeze detectors, and shut-off valves.

These are easy to install in any home and can effectively prevent and mitigate water-related incidents. VYRD goes beyond promoting and distributing IoT devices with their own proprietary data processing and mitigation platform.

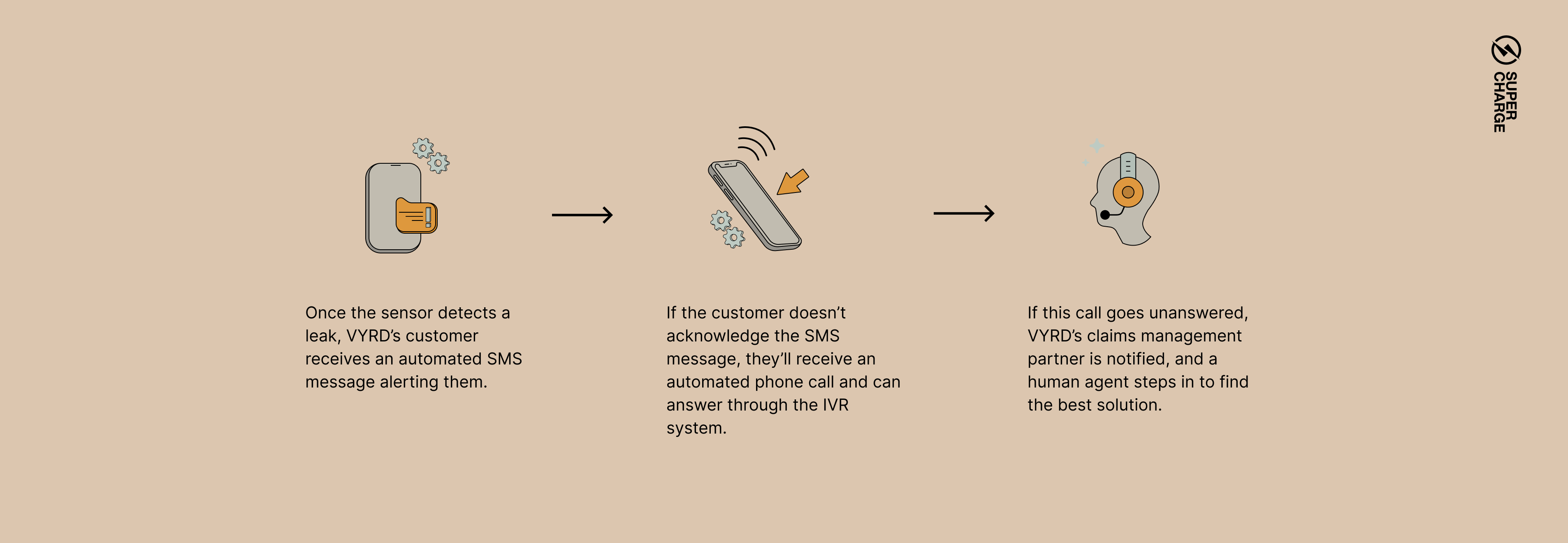

VYRD customers can opt in for the water protection and receive a free leak detector kit. Once installed, they get an immediate discount. Programs like this are fairly common, and most stop at this point - but VYRD takes it further by feeding sensor data into its proprietary data processing system. The carrier partnered with Notion to provide sensors and underlying infrastructure. Data arrives to Notion’s servers and is then forward to VYRD’s system - any leak incident starts a multi-step sequence to ensure the earliest possible mitigation.

Proactive fire prevention

StateFarm offers proactive protection on one of the more frightening perils: electric fires. Though only 0.26% of policyholders annually report a fire claim, the average claim severity is among the highest, close to $80,000.

In addition to being costly, a house fire evokes strong emotions that feed into a common bias, known as the availability bias. Events that generate strong emotional responses are more easily remembered and therefore perceived as more likely to occur than they actually are. To address electric fire, StateFarm partnered with Ting to uncover hidden electric hazards in homes.

Ting’s beauty lies in ease of use: the customer simply plugs the provided unit into an outlet and sets it up with Ting’s mobile app. From there, Ting measures electrical activity and identifies dangerous irregularities, like tiny electrical arcs. These can be precursors to imminent fire hazards, from faulty wiring an issue with an appliance. The plugged-in unit continuously monitors the network.

When a risk is identified, the app notifies the homeowner and Ting’s remote fire safety team. The team then reaches out to the customer and leads them through mitigation. As an end-to-end service, Ting can dispatch certified electricians to fix underlying issues and even pay up to $1,000 in expenses.

StateFarm is Ting’s largest partner, and the model of the program is characteristic of how insurers engage with the smart home space: they market and subsidize devices and services but rarely build proprietary tech around it. StateFarm pays for Ting devices (which cost $349) but do not offer premium discounts for opting in. Ting helps StateFarm to:

An opportunity for the future

The thought of a stranger breaking into our home strikes at the core of our sense of security. It’s no surprise that home security is very active for startups, offering complex systems, video doorbells, smart security cameras, and smart door locks that promise peace of mind for homeowners. While burglary is worrying to everyday people, it’s not very risky from an insurance perspective - as theft claims are both low in frequency and severity. On top of this, national statistics show a steady decrease in burglaries over the past 20 years.

This may be the reason why insurers are not putting much effort into innovating in the smart home security domain. Most insurance companies are willing to offer a small premium discount if the customer installs a smart security solution, but these discounts are often not heavily promoted and customers can achieve similar savings with a simple deadbolt.

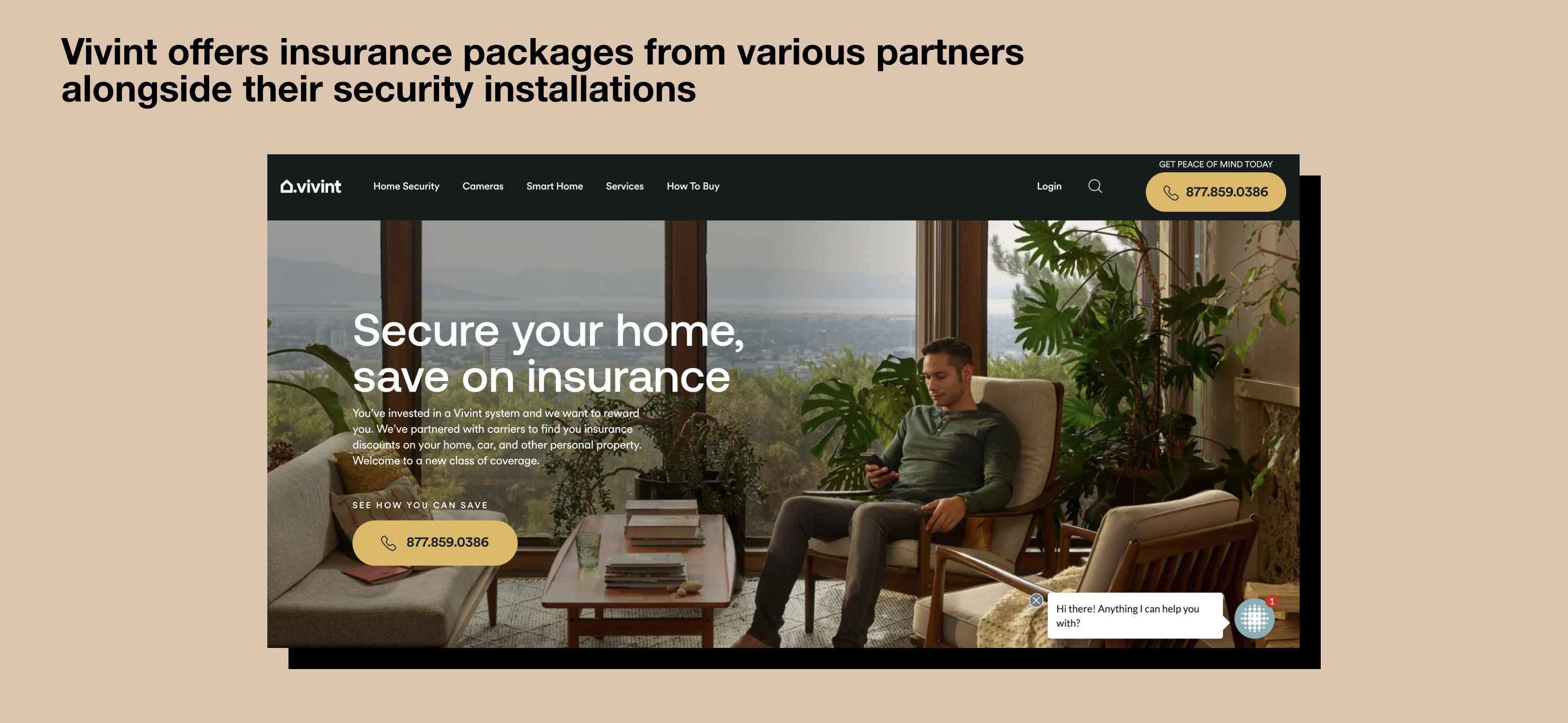

Home security systems offer the most comprehensive protection, but they can also be the most expensive and require professional installation. Options range from high-end systems like Vivint and ADT to more affordable systems that can be self-installed.

The latest wave of devices trade professional performance for simplicity and ease of setup - key features for popular systems like Simplisafe, Ring Alarm Pro, and Adobe Smart Security Kit. All proper home security systems offer professional monitoring for a monthly fee, but customers can also choose self-monitoring. These systems can be customized for a home's specific needs and protection level, with options including indoor and outdoor cameras, entry detectors, motion sensors, and sirens.

We did not find any major insurance carriers with advanced integrations to these solutions, but they often promote the devices and offer discounts to customers.

Vivint, a security company being taken private by energy company NRG, is one of the most innovative players in this market. They offer insurance packages from various partners alongside their security installations, which may include premium discounts due to the added security layer. According to the company these discounts can be as high as $650, though this may be an extreme case because theft generally has a low impact on homeowners' insurance risk calculations. Vivint plans to expand their insurance offerings by potentially becoming an MGA and program administrator to offer more customized insurance products to their customers.

Smart doorbells are a simple security solution that provide convenience and security at the same time. The idea is that the main entry point to a home, the front door, can be monitored for unwanted visitors.

In 2015, AmFam ran a promotion where Ring, the video doorbell company, promised to reimburse customers' deductible in the event of a break-in. Ring's CEO said their global customer data showed that the Ring Video Doorbell significantly reduces the risk of home break-ins. However, most insurance companies do not offer premium discounts for video doorbells because they rarely include professional monitoring, and self-monitoring can be ineffective in catching intruders.

Smart locks are generally about convenience, not security. They enable you to access an apartment or home with a PIN code or biometric identification (read: fingerprint) and can usually be configured remotely. Almost no carrier gives discounts or actively promotes these. The only exception is Liberty Mutual, which gives a few percent premium discounts for installing an August Smart Lock on one’s entry door.

Smart security cameras come in various forms, from simple devices that can be monitored remotely with a smartphone to more advanced solutions. Allstate offers a 30% discount on the Canary device and an additional 5% premium discount if the user signs up for a premium plan that activates the “person detection” feature. If this function is active, the camera sends notifications when it detects intruders and allows the owner to trigger a loud, 90-decibel siren to deter burglaries.