becoming a mobile powered bank

In 2015, the Multitude group decided to launch an entirely new business line by acquiring a banking license and launching a cross-European mobile bank to capitalize on the rising demand for seamless mobile banking experiences.

The challenger bank swiftly launched in 2016, gaining tens of thousands of new customers from across half a dozen countries where it was available. Our team is proud to have supported this journey all the way.

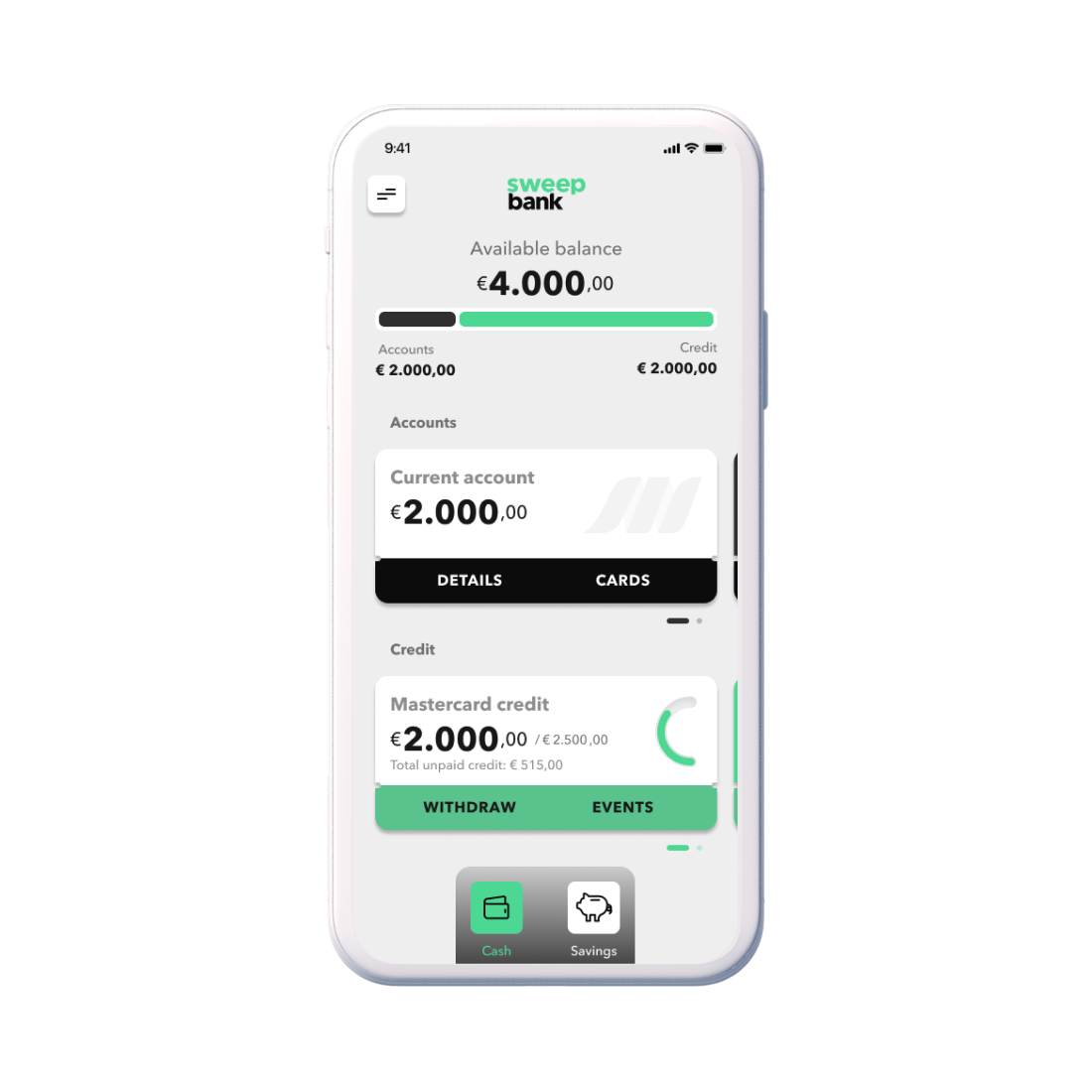

In just nine months, we re-platformed Sweep Bank, leveraging Tuum’s core banking solution. The transformation included a complete redesign and redevelopment of the mobile banking experience, the implementation of a unified orchestration layer, and the development of nine microservices for deposit management, push notifications, customer communications, device management, and more.

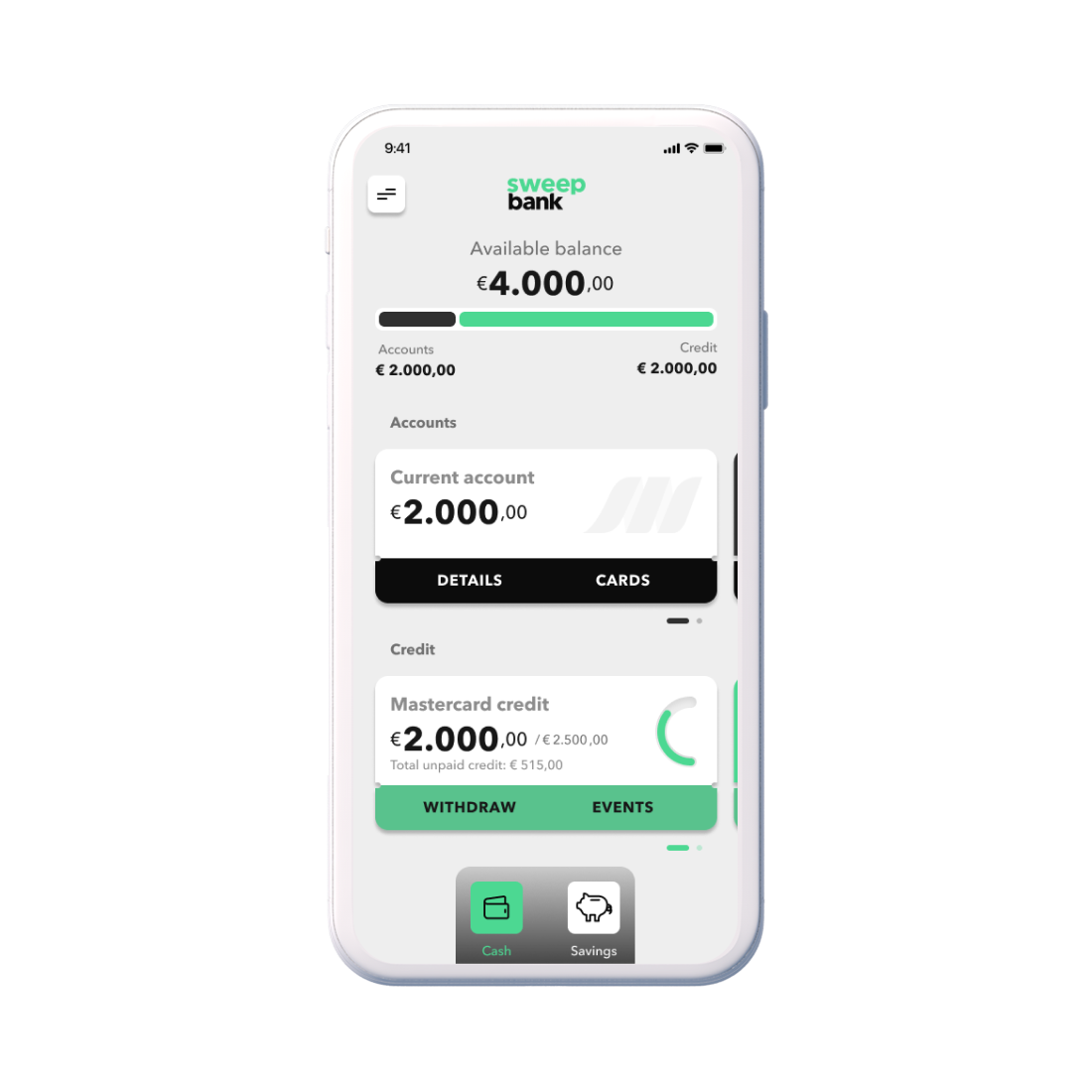

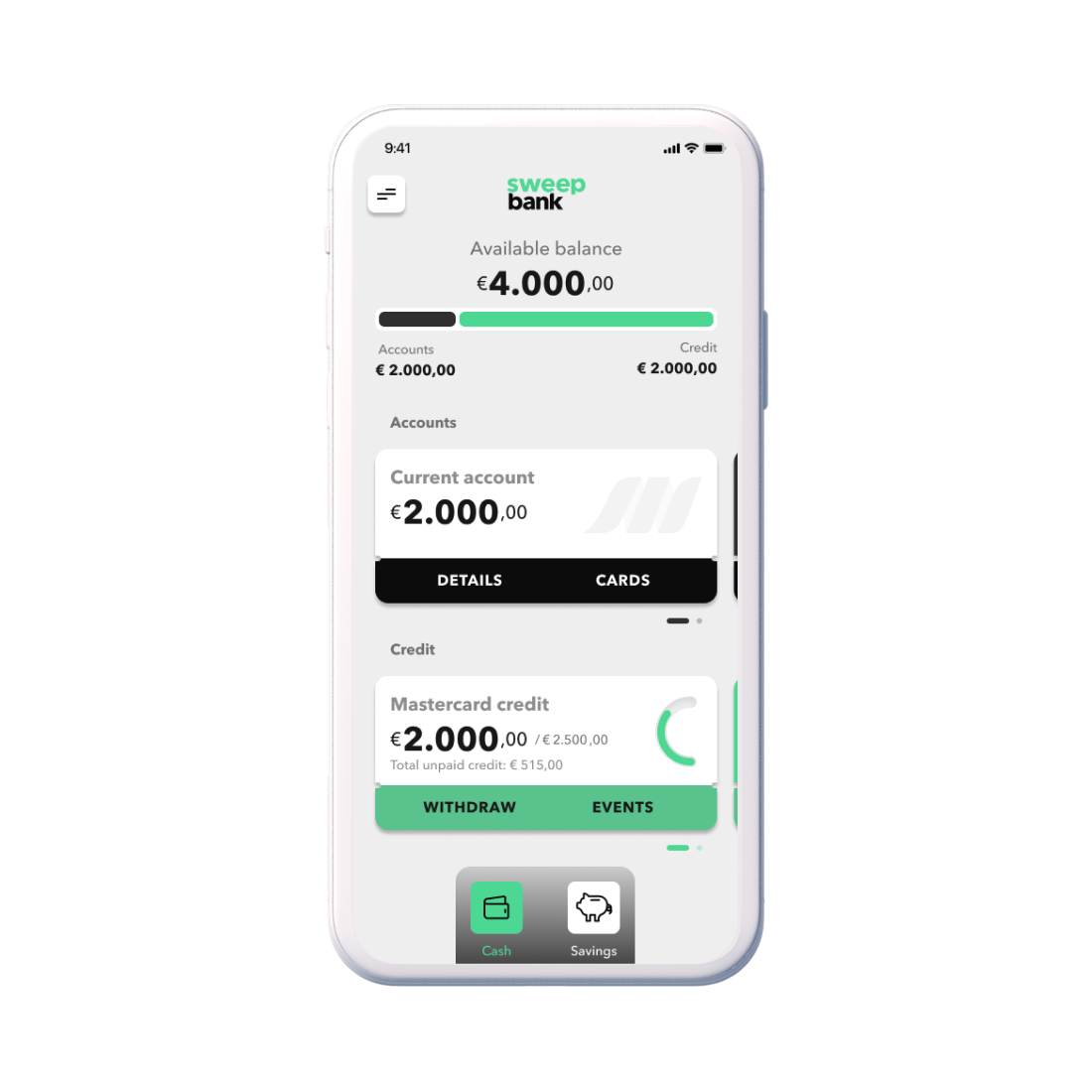

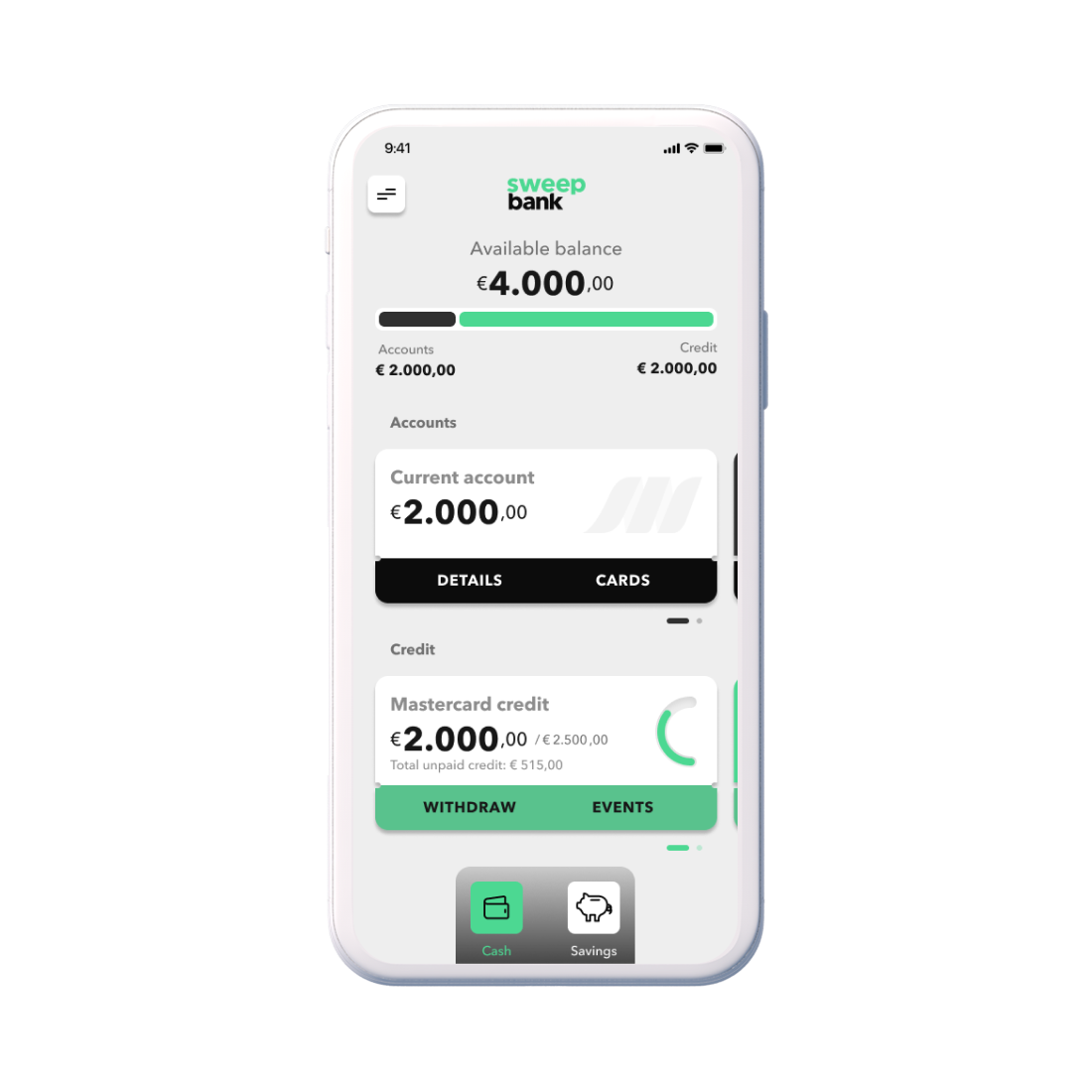

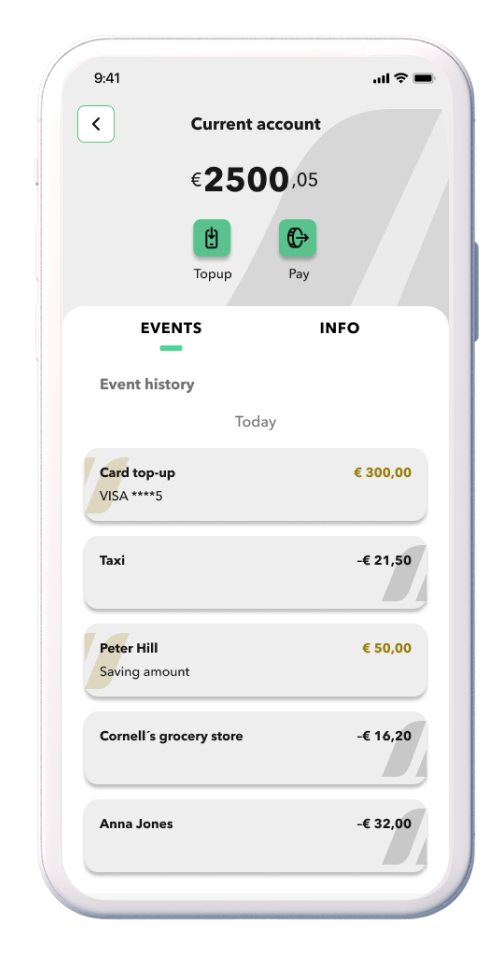

Sweep’s mobile banking offering is centered around one core promise: you can get a new bank account in minutes that is ready to use around the world.

There is a short and seamless onboarding experience as the background check is quickly completed and you are ready to use your bank account instantly and your debit card ships to you.

But Sweep Bank is about much more than just a quick-to-set-up of a current account:

the service offers multi-currency accounts, no foreign exchange rates, free ATM withdrawals, SMS payments and savings functionality.

|

The bank offers a large variety of saving options with goal savings functionality and “Boosters”, an automated micro-savings product, included. Innovative saving products are just one of many product features - as a completely new customer, it is possible to apply for an overdraft within minutes, giving you financial flexibility when you need it. |

To ensure all customers across the globe enjoy the same seamless digital banking experience, localisation was carried out using our partner's tool, Lokalise.

Within six months, we helped to design and develop a completely new experience that is gradually being rolled out to customers. The changes are not only happening on the surface: the bank moved to a new core banking and a state-of-the-art, microservices-based middleware to power a high-performing, seamless new mobile experience.

We relied on our knowledge and experience in building three different mobile banks and dozens of microservice architecture implementations to guide our client on this transition.

share this post on