share this post on

this article is part of our Prevention tech in insurance whitepaper

Usage-Based Car Insurance is one of the most prominent innovations in Auto Insurance. This approach uses real-world driving data to create more accurate underwriting models and personalized pricing.

By measuring a customer's actual driving behavior, the need for proxy details like age, gender, and credit score decreases when assessing risk. This allows insurers to offer fully personalized pricing based on how, when, and how much a customer drives their car.

While the first wave of UBI programs involved the use of onboard units (OBUs), which were plugged into a car's analytics port to collect data, today almost every large carrier relies on technology that uses the customer’s phone as the sensor.

In this article, we give an overview about the usage-based car insurance landscape and showcase three inspiring prevention offerings from the auto insurance industry.

How they drive

Good driving is mainly characterized by avoiding speeding and hard braking. Modern smartphones are equipped with built-in sensors that effectively measure factors like speed and acceleration – or even additional factors like cornering. Additionally, phone usage is its own factor – distracted driving from phone usage increases the odds of a crash. NHTSA reports that 87% of rear-end crashes involve driver distraction. Some carriers take phone handling into account when determining a customer's risk profile, while others simply try to discourage phone use while driving.

When they drive

Carriers vary in how they define time ranges, but the day is always divided into lower risk and higher risk periods. In general, driving at night and during high traffic times is higher risk. This creates a problem for people whose jobs require them to drive during these periods, potentially making them ineligible for UBI products.

How much they drive

Any time a car is in motion, there is a risk of an incident occurring. Many carriers use distance driven as a factor in determining the risk associated with a particular customer. This is often used to place customers into different risk brackets, with those who drive longer distances considered to be at higher risk.

Looking at the tech: Empowering UBI at scale

Almost all large carriers are leveraging third-party solutions for telematics, with Cambridge Mobile Telematics being the clear leader in the space. Carriers can license and customize CMT’s DriveWell product, and either offer it to customers as a standalone app or integrate it into core customer apps. Two out of the three carriers we benchmarked are leveraging CMT’s solution, with AllState being the outlier utilizing homegrown telematics tech.

How customers see UBI

Customers are attracted to UBI program discounts, as most are given risk free, without customers having to worry that their premiums will increase if they have bad driving habits. Overall these programs are well received as long as the technical solution is stable and unobtrusive.

Still, after extensive netnographic research, we identified four types of negative reviews consistent in every carrier’s programs*.

1. Assessment fairness

Many people believe that they are excellent drivers, and cite certain situations where it is crucial to suddenly brake in order to avoid a collision. Insurance companies argue that by analyzing a large number of recorded trips, patterns will emerge and these edge cases will even out. However, customers' subjective perception of their own driving skills doesn’t always align with this data.

2. Driving vs. riding

A major limiting factor in most UBI solutions is the difficulty in figuring out if someone is driving a car or just traveling in one. As a remedy, most programs allow the user to qualify trips as a passenger – but for drivers who regularly alternate between the two roles, there are frequent complaints about the extra administration.

3. Data gathering

Customers recognize that nothing comes for free and that they “pay” for discounts with their data. Some customers do not trust their carriers to use this data fairly, and feel that the value exchange is not balanced in their favor. This doesn’t come as too much of a surprise, as auto and home insurers consistently rank low in consumer trust in general. (1)

4. Technical issues

Driving can be stressful and apps have to work flawlessly to avoid additional stress. When convenience is compromised, such as when a user is logged out or trips are not tracked properly, it creates a poor customer experience that is detrimental to the carrier. This serves as a warning to insurers looking to innovating their customer experience: entering customers' daily lives creates exposure they didn't have before.

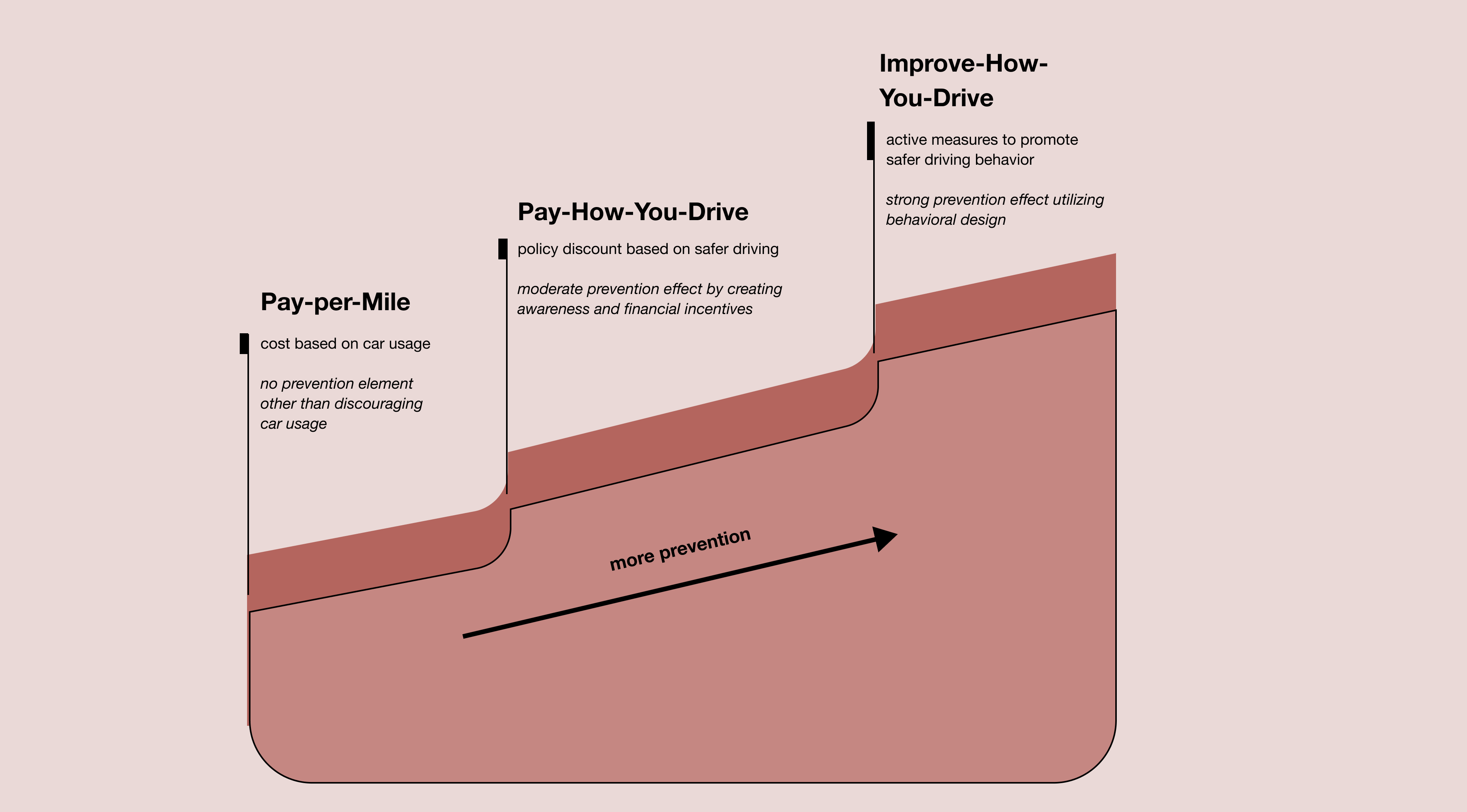

Not necessarily. We categorized UBI programs into three levels depending on its possible positive effect on driver behavior. Level 1 programs simply encourage drivers to use their cars less, while level 2 programs offer incentives for safer driving and have a moderate prevention effect. Level 3 programs actively leverage behavior design techniques to improve users' driving habits.

Allstate is one of the few large carriers that placed an early bet on UBI by developing an in-house telematics solution (since then it’s spun off as Arity, an insurtech subsidiary). Most competitors opted for licensing the technology from specialized insurtechs - saving on cost and speed to market, but ending up with no IP of their own. According to data disclosed by Allstate, both their Drivewise and Milewise programs proved to be successfully adopted, with up to 40% of new customers enrolling in either program (2).

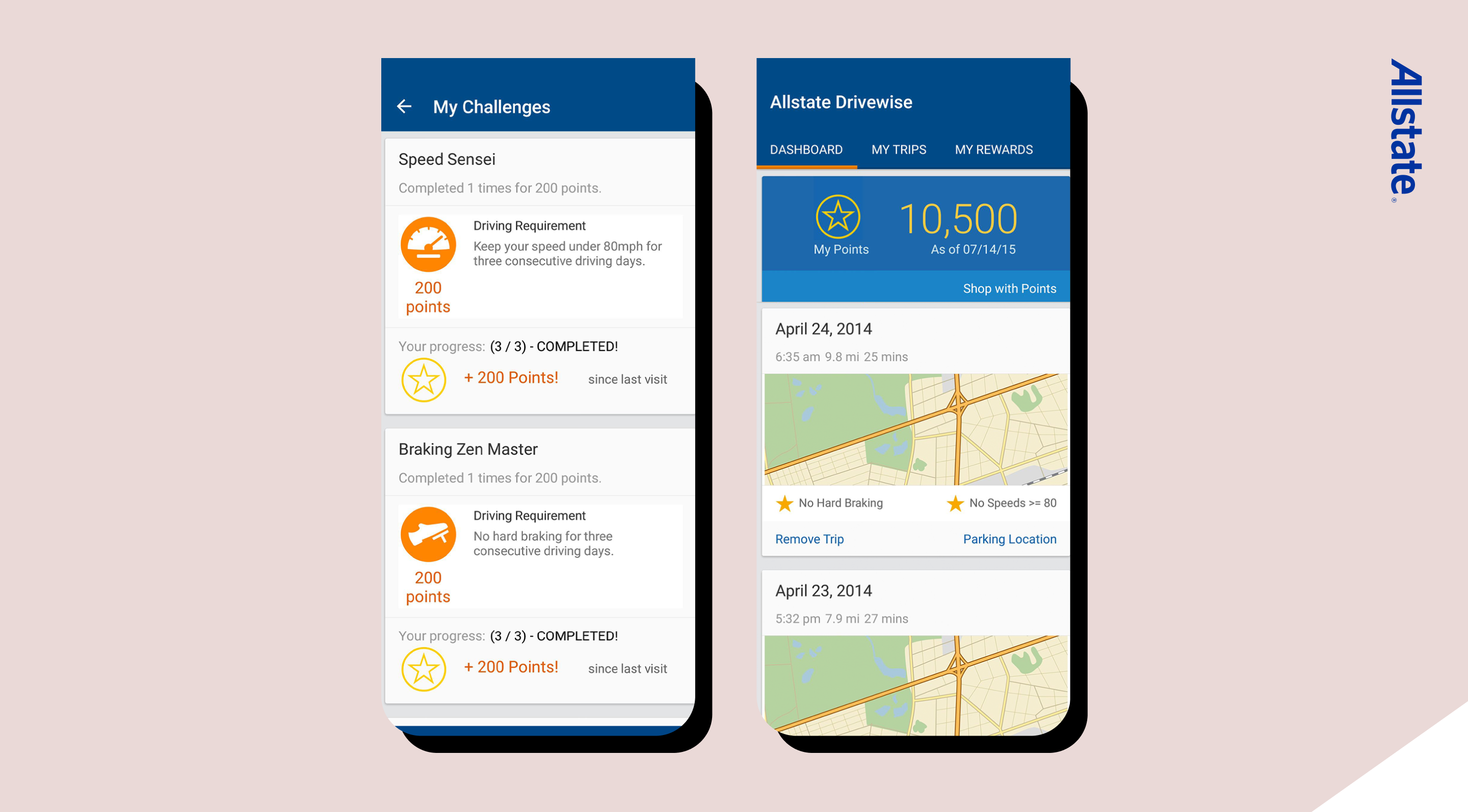

The Drivewise program offers a policy discount as an incentive to sign up, which the company says can increase up to 40% after the first 50 completed trips, depending on the safety of the driving.

Note: These incentives may vary by state due to differences in regulations.

The program requires continuous participation as the policy discount is recalculated every six months. In contrast, some other programs (like Liberty Global’s RightTrack) offer a lifetime discount after an evaluation period. (3)

The company has added a crash detection feature to its program, which will call for assistance if the phone detects signals of a potential accident. Apple's latest update to iOS also includes this feature, but insurance companies may have an advantage by linking it to a smooth claims experience.

To reduce the risk of accidents, the program aims to encourage customers to adopt safer driving habits and increase their awareness and self-reflection. Additionally, Allstate has introduced active “improve how you drive” functions as direct rewards after trips.

Level 1 - Awareness

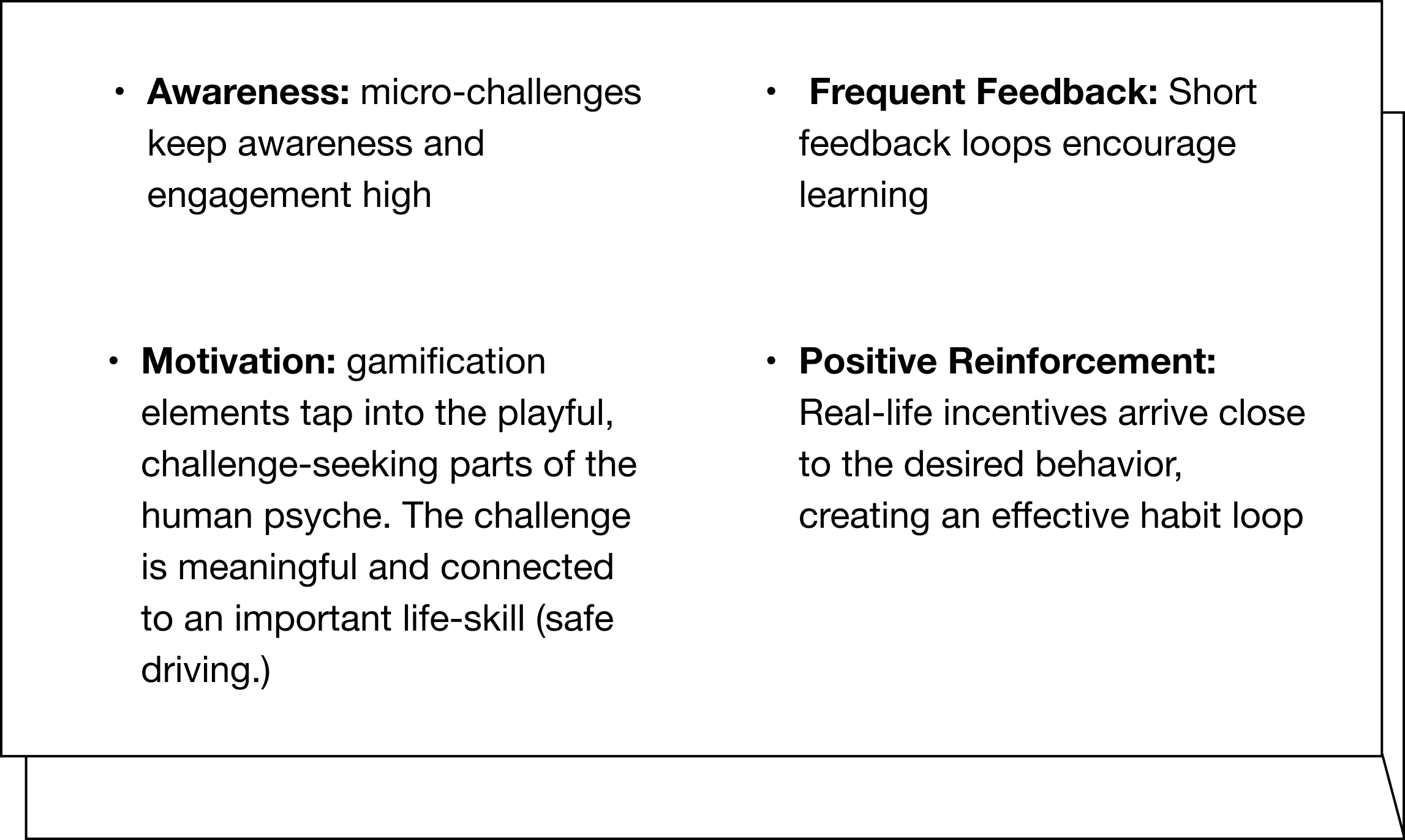

The fact that customers are aware that their driving performance is being constantly monitored and evaluated, and that their results can lead to financial benefits, is an inherent motivator to improve driving behavior. The issue with relying solely on awareness and financial incentives is that they may not be enough to maintain improved driving habits over time. Without constant reminders and more immediate motivators, users may revert back to previous driving behavior as the novelty wears off. Fortunately, Allstate has implemented additional measures to address this issue.

Level 2 - Feedback

The app provides feedback on driving performance by monitoring essential elements of safe driving, such as hard braking, speed, and daytime driving. This data is presented to the user in an easy-to-understand format, with a breakdown of results for each trip. In Allstate's program, phone usage events (a major cause of distracted driving) are also recorded and shown to the user, but they do not affect the risk score.

Level 3 - Micro-feedback + Rewards

Allstate recently stepped up its game with the addition of the Allstate rewards program to Drivewise. After awarding the user with initial points (10k for signing up, 5k for learning about the reward program), the program invites customers to participate in mini-challenges, like completing a three-day streak without hard braking or speeding, or completing ten safe trips. Every successful challenge tacks on 200 points which are redeemable for savings on daily deals, gift cards, sweepstakes entries.

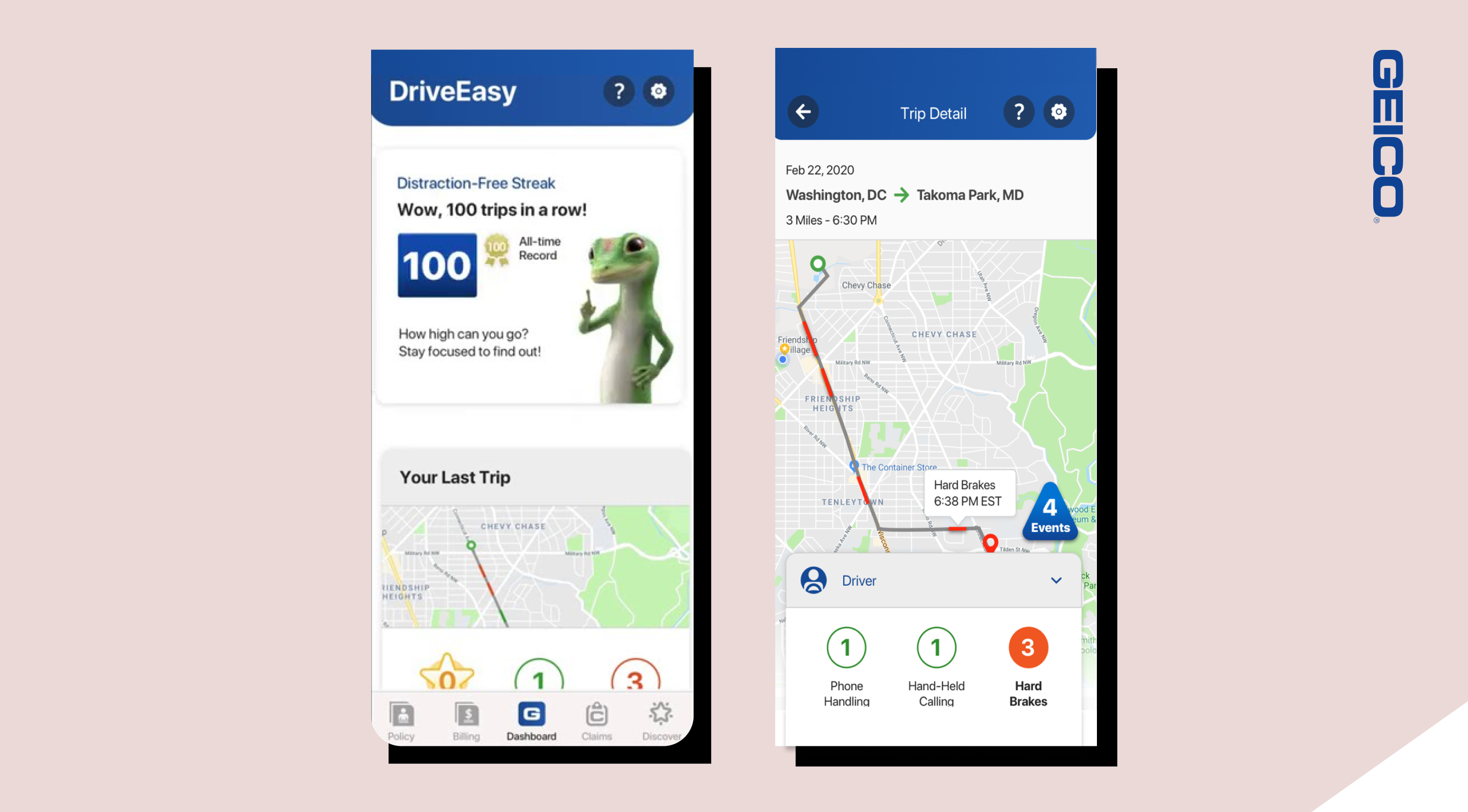

Geico was admittedly late to UBI and only embraced its importance in 2019. (4) Unlike Allstate’s homegrown tech, Geico relies on Cambridge Mobile Telematics to power their UBI program, DriveEasy.

DriveEasy began as a standalone mobile experience, but it was later integrated into the insurer's main app. Geico promises up to 25% savings to participants based on their driving habits. Some of these savings come in the form of a sign-up bonus, while the rest are provided after the first renewal. In some states, insurance companies are allowed to increase premiums for especially reckless drivers, and Geico reserves the right to do so according to the program's terms and conditions.

Geico requires that customers keep the app on the phone and enable location services, or they’ll lose the premium discount. This gives an added prevention angle, unlike other programs that establish a driving score in an initial period but don’t require continued monitoring.

Compared to Allstate, Geico measures a more detailed dataset to establish a driver’s risk level, paying attention to external factors like the weather and road conditions. This list shows an advanced level of data processing, as it needs to continuously correlate various external circumstances with the user’s GPS location:

Geico heavily prioritizes distracted driving, and research supports this position; post-pandemic trends show US drivers are using their phones mid-trip more than ever. According to the NHTSA, interacting with a smartphone for just two seconds doubles the odds of crash risk while driving. DriveEasy measures two types of phone distractions:

Level 1 - Continued Monitoring

The app continuously monitors the user's driving style, and the potential financial rewards or consequences associated with the driving score serve as an incentive for the user to improve their driving habits.

Level 2 - Feedback

In addition to the overall driving score, the app also provides detailed breakdowns of the user's driving performance in various categories. Driving mistakes are highlighted on a trip-by-trip basis, and can even be displayed on a map to help users remember how a particular incident occurred.

Like most programs, users can designate trips as passengers to remove it from their history. The detailed feedback provided by the app enables users to reflect on their driving habits and identify areas for improvement; if their scores improve over time, it shows that they are making progress in improving their driving habits.

Level 2.5 - Gamification(ish)

Currently, Geico's app lacks many of the behavior-influencing elements that we’ve seen in the most advanced programs. There is a gamification feature that rewards users for maintaining a streak of distraction-free driving, but it does not utilize other behavioral design techniques or offer rewards for successful completion. As a result, it may only be motivating to a small subset of users.

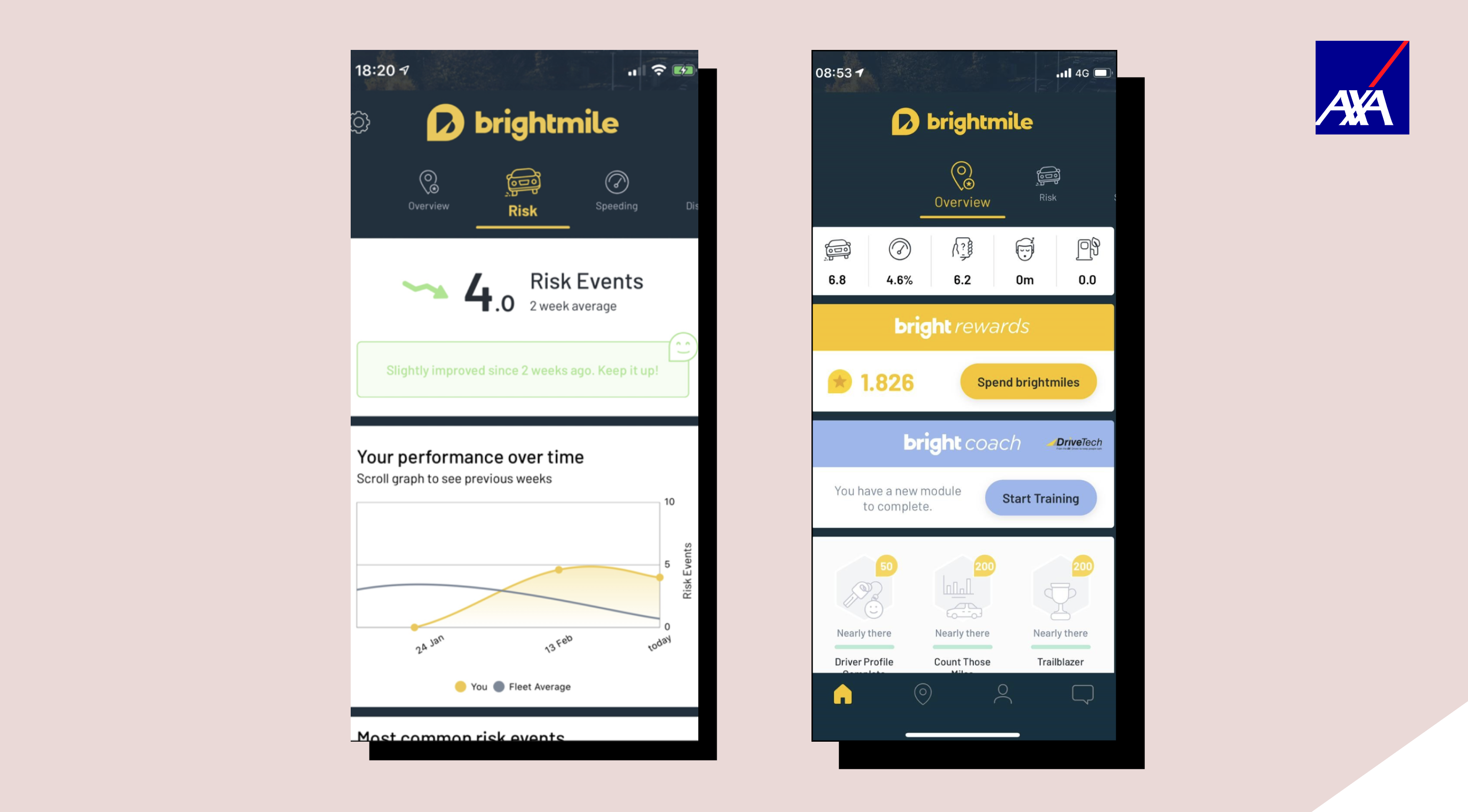

AXA’s Usage Based Insurance program is powered by a third-party system, called Brightmile. It is a dedicated fleet risk management application available for commercial use only.

After the Brightmile app is downloaded to the driver’s phone, it automatically detects and tracks trips and will reward the driver for safe driving. Besides actively helping drivers to pick up safer driving habits Brightmile also provides an online platform to managers to get insights about those trips and individual drivers.

AXA offers the Brightmile service to its commercial clients in the UK for £5 per driver per month, without any upfront costs.

What does Brightmile measure?

Brightmile measures and analyses the following to determine driver safety:

Brightmile builds heavily on different gamification techniques to promote safer driver behavior. Some key elements of gamification that is leveraged in the Brightmile mobile app:

Since the driver’s performance is clearly displayed over time and against others in the fleet, it can lead to self-improvement and competition. Altogether the service that AXA provides with Brightmiles is quite similar to Drivewise, in the sense that its aim is long-term engagement and habit-building.

The Brightmile app provides a driver training program with targeted driving technique training to its users. The modules are designed to address specific areas of improvement that are identified through real-life performance. The program is fully integrated into the Brightmile app, making it easy for drivers to access and complete the modules at their own pace.

The program rewards drivers for every module they successfully complete, which serves as an added motivation for them to improve their driving skills and lower the risks of being involved in an accident. It is an effective way to enhance the driving skills of drivers, and the rewards system helps to keep them engaged and motivated to continue learning.

Trips are classified as either business or personal, and this classification can be done automatically based on the driver's specified working days and hours. With this feature, managers and drivers can be sure that only business-related trips are being tracked. Additionally, the program uses machine learning to automatically classify non-driving trips, such as when a driver is on a train. Drivers also have the ability to manually reclassify trips and edit start/stop locations for added accuracy.

Managers also get access to an online portal from Brightmile, where they can gain actionable insights about their drivers driving habits and areas for improvement to further increase safety.