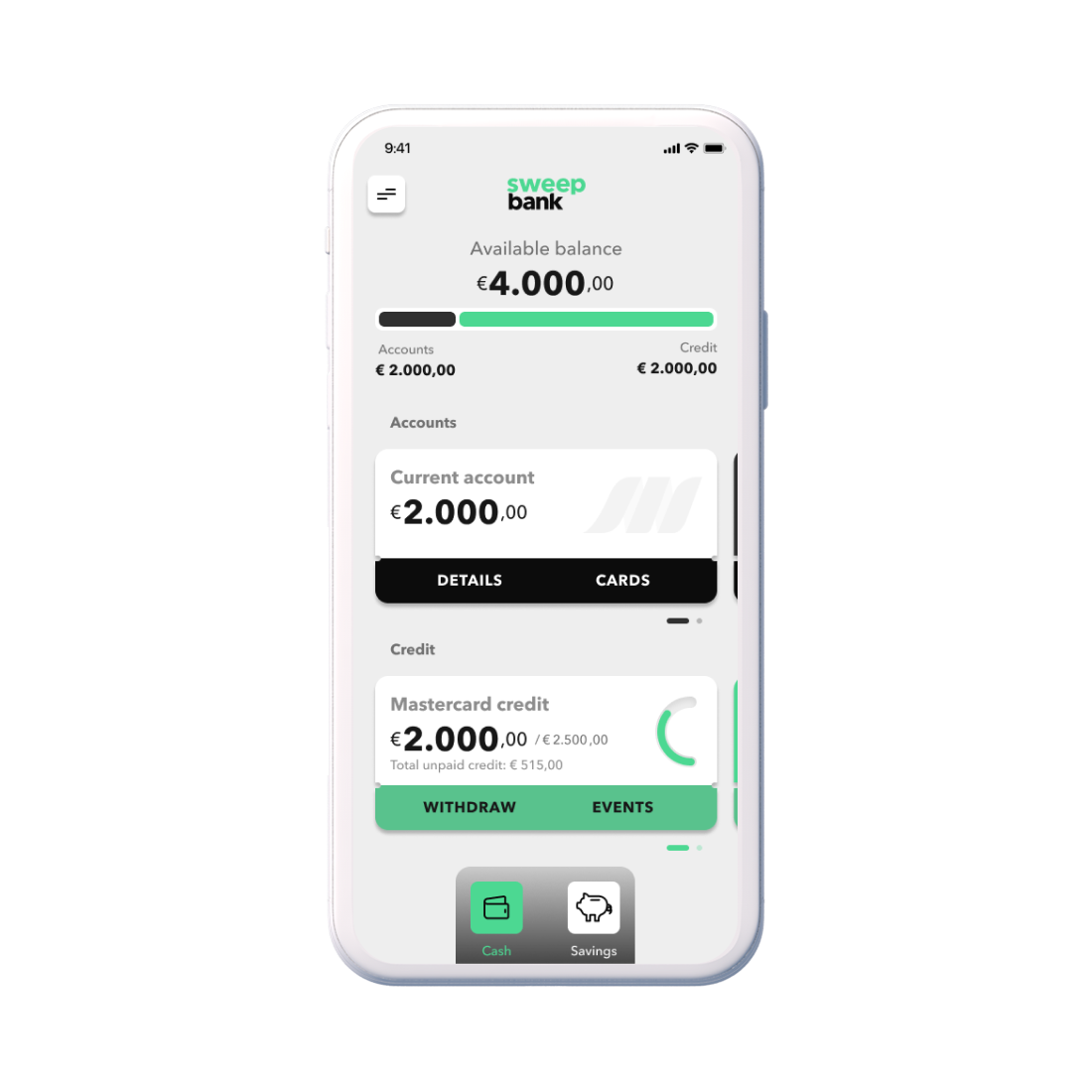

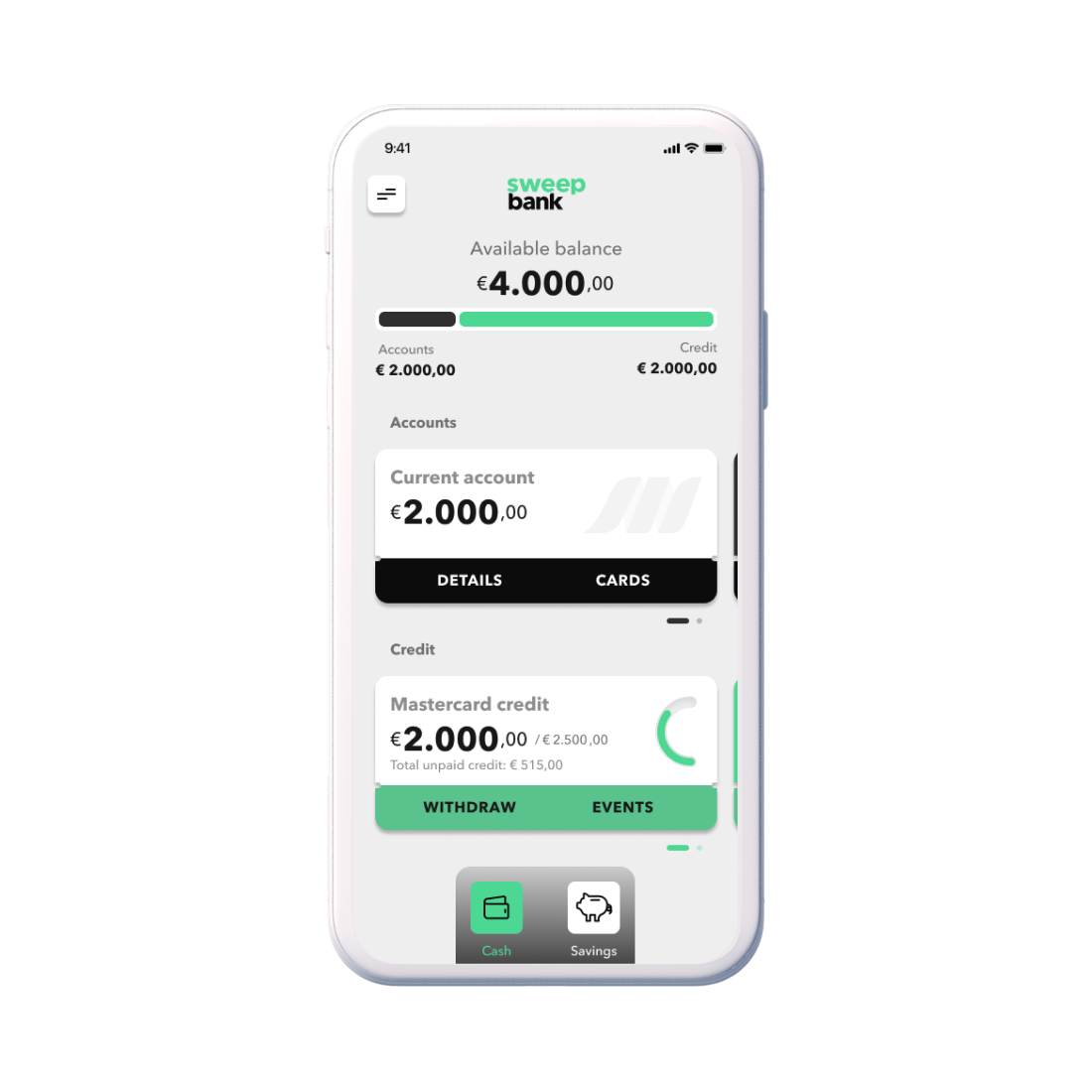

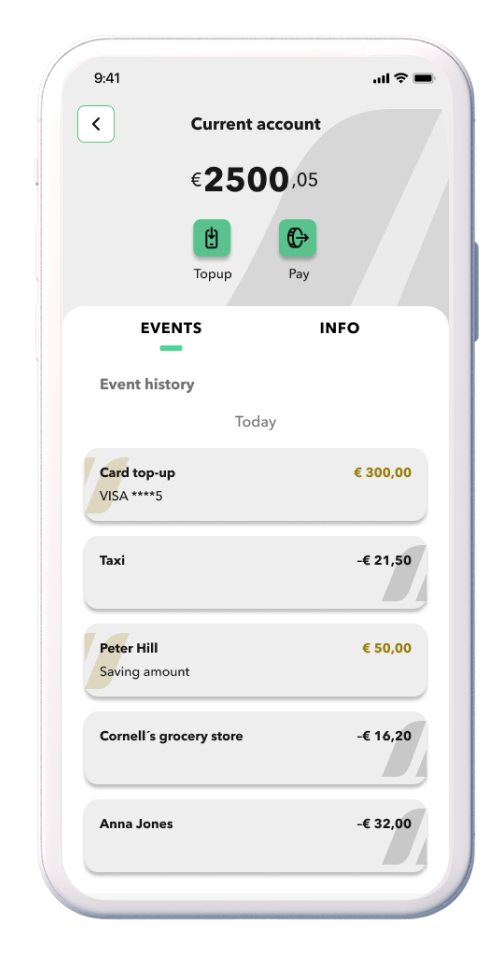

becoming a mobile powered bank

Sweep Bank, part of the major Nordic micro-lending player Multitude, decided to launch a cross-European mobile bank to capitalize on the rising demand for seamless mobile banking experiences. Our team is proud to have supported their journey to become a full-fledged digital bank.