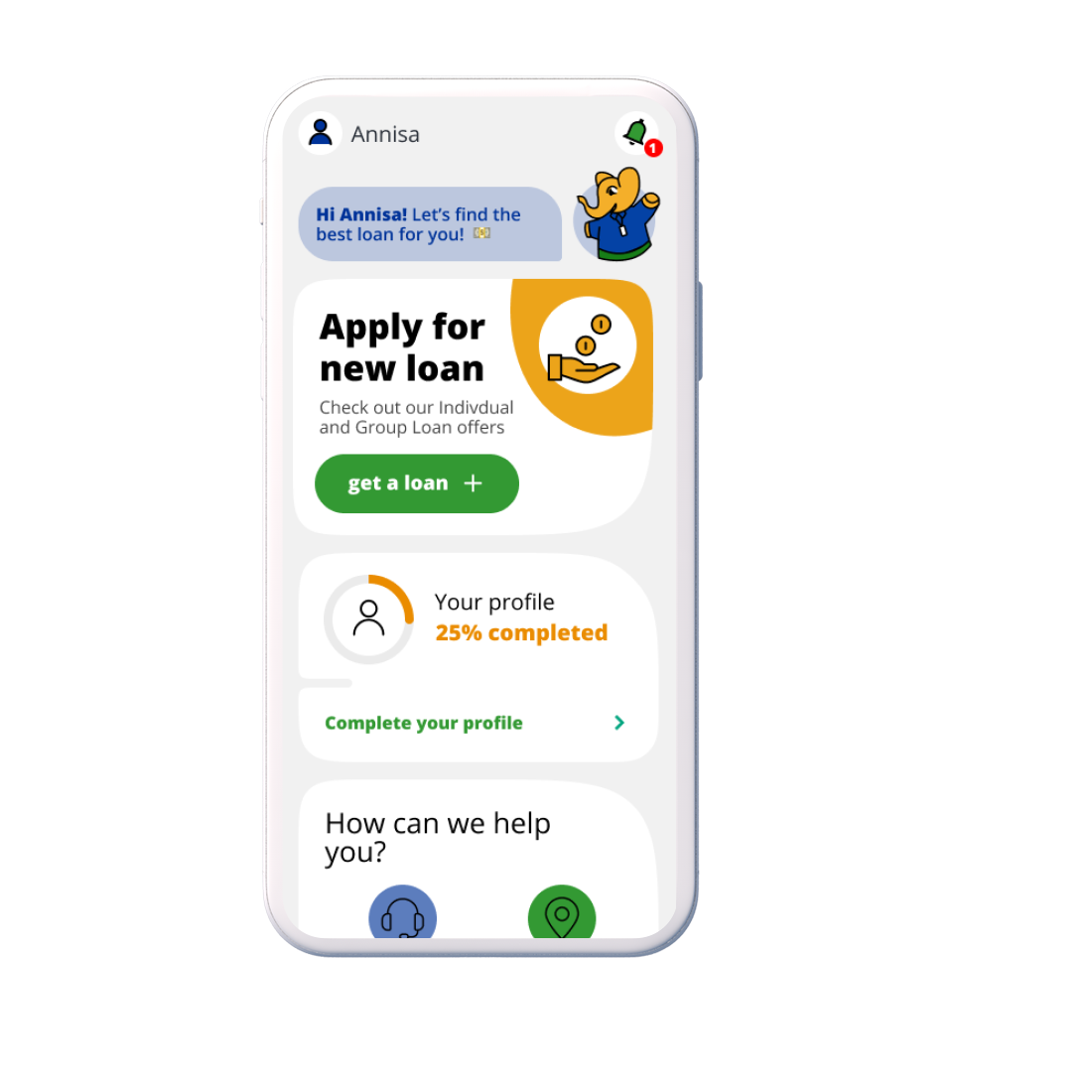

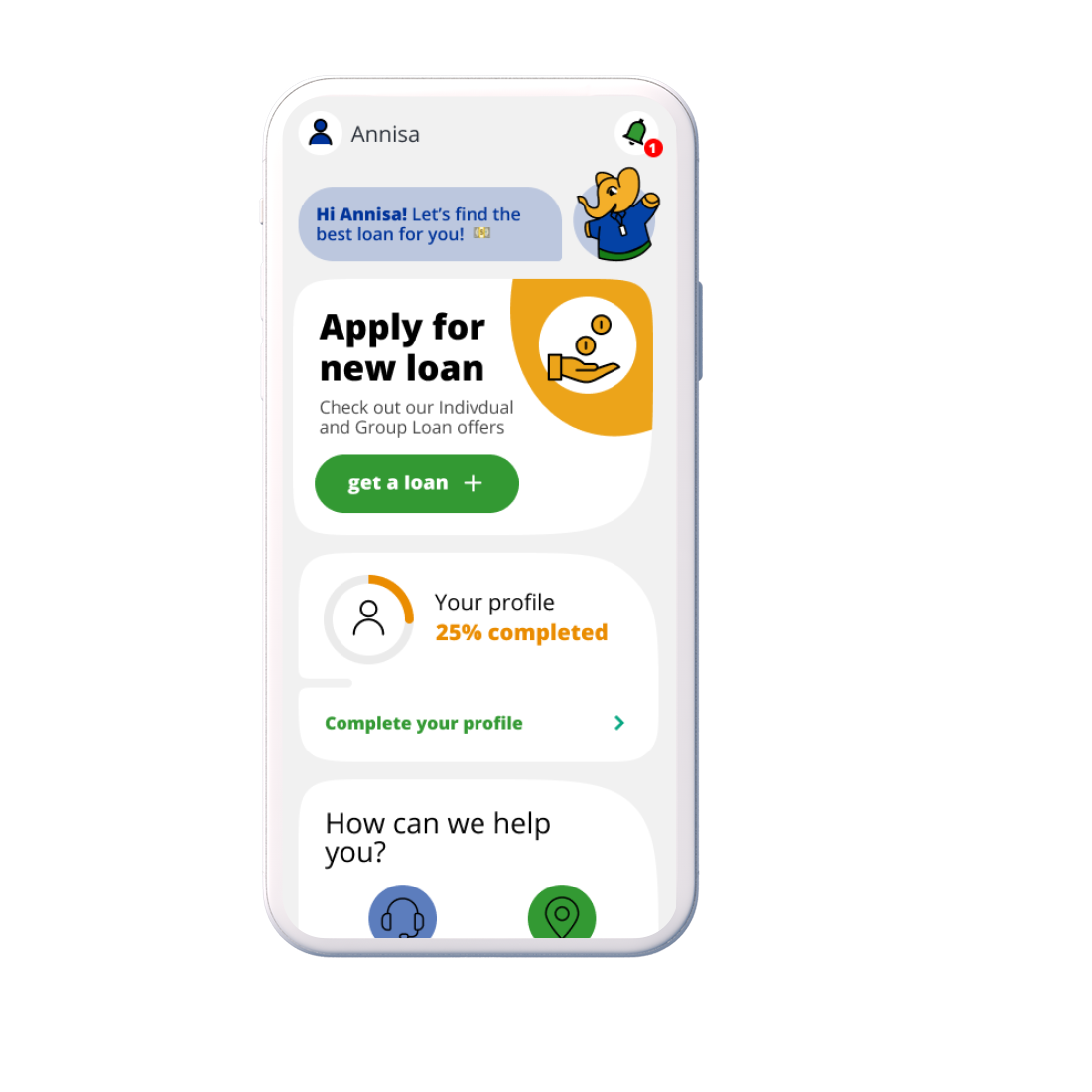

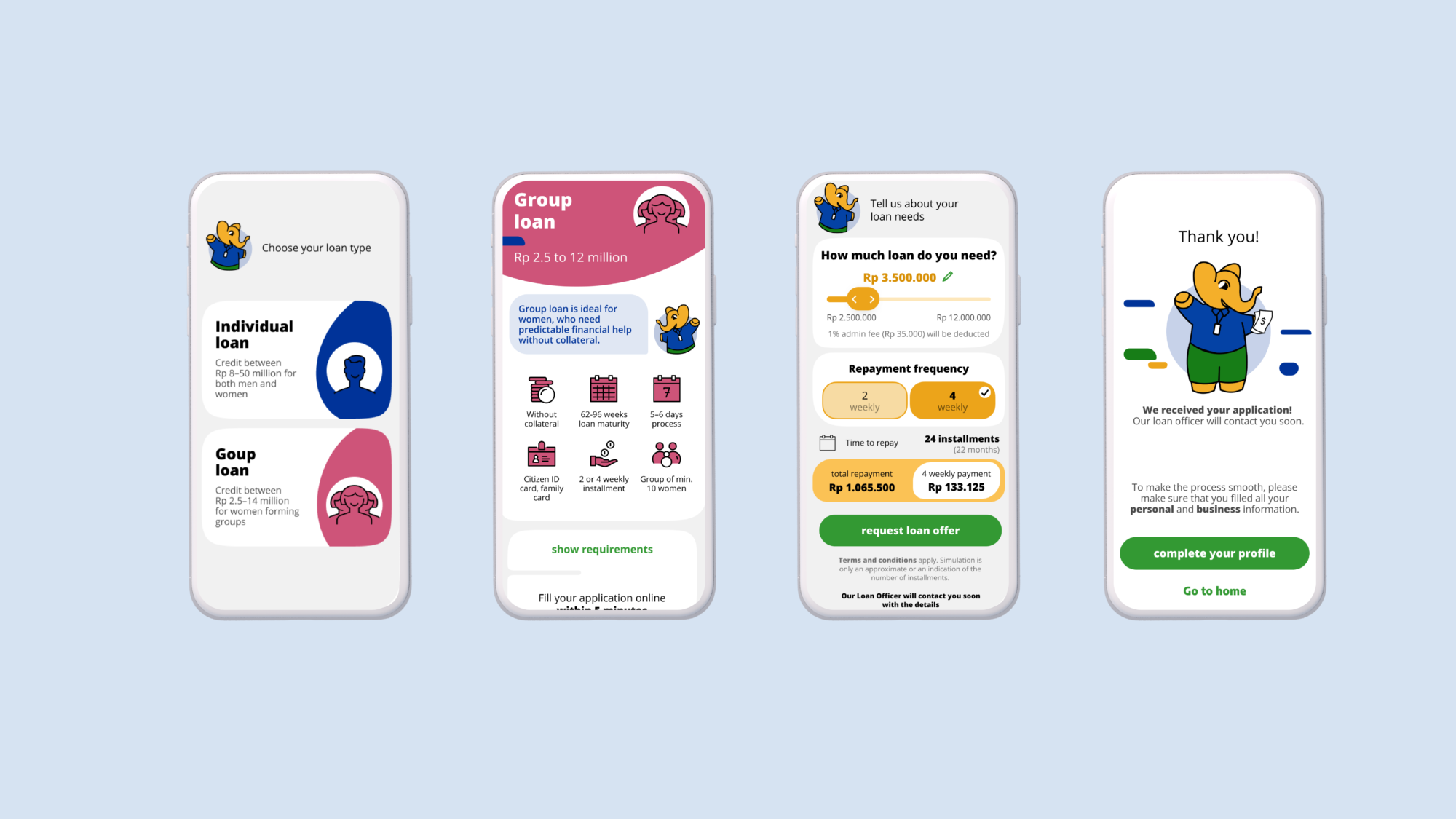

mobile loans to fight poverty

Bina Artha’s mission is to fight poverty by providing micro-financing services in Indonesia. Their mobile app allows underprivileged women living in distant rural areas of the country to apply for loans and track their repayment progress online on a simple, playful interface.