In Sortter’s league, search engines are the ultimate starting line of this crazy race. To ensure the best possible position for their website in Google, our team carefully ticked every technical requirement from our ultimate search engine optimisation best practice list.

As a result, Sortter set its name in stone on the top of the most relevant search queries and considerably boosted its services’ findability.

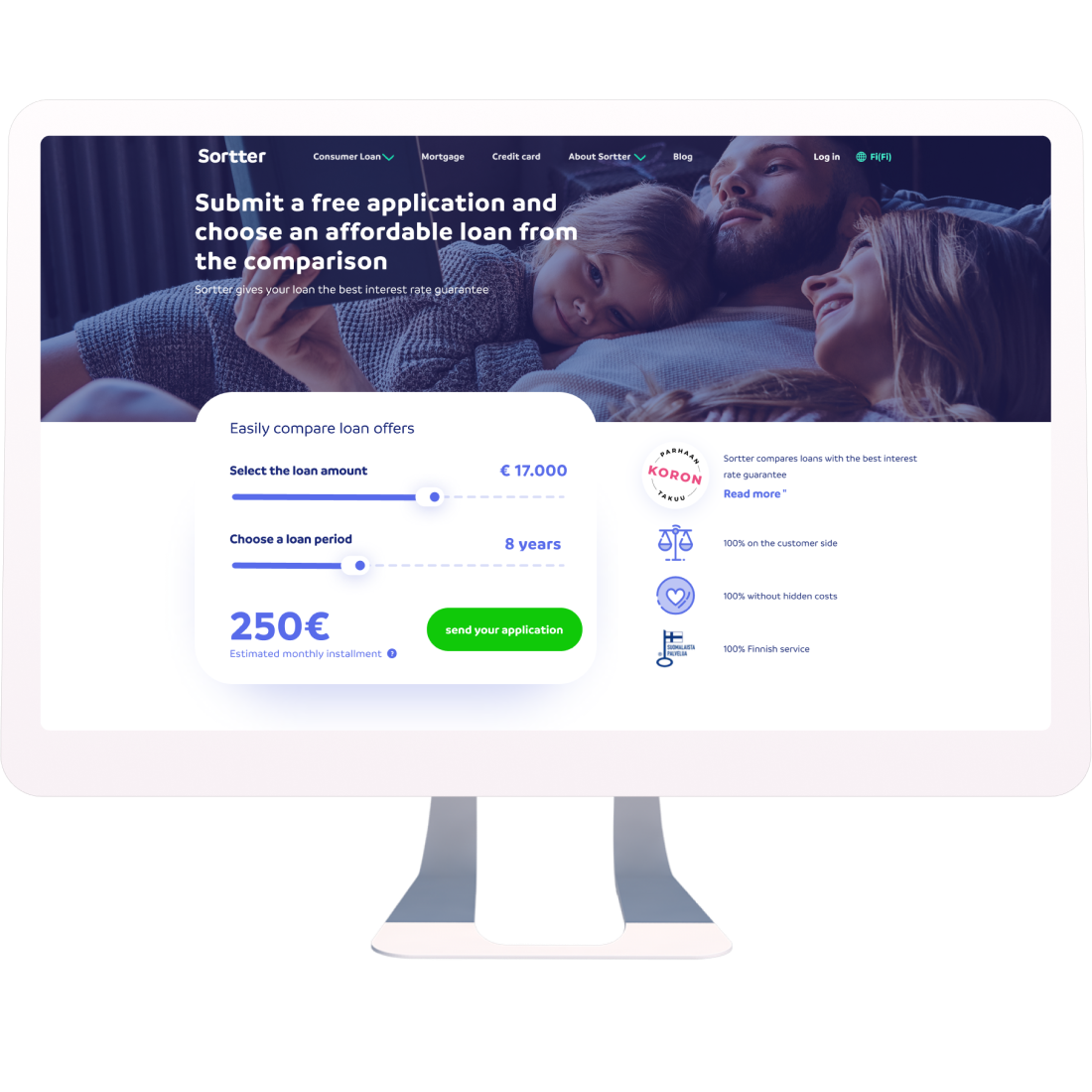

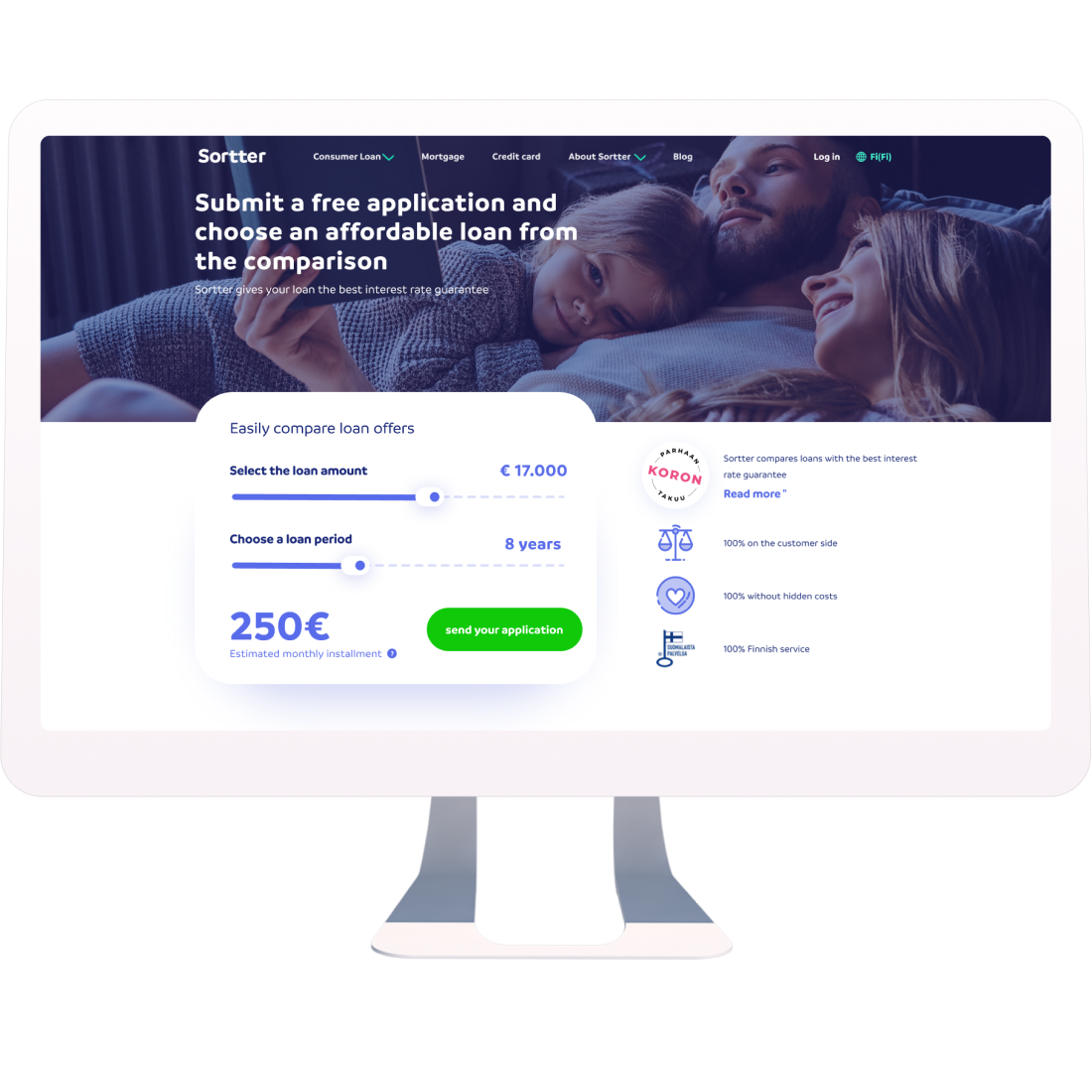

Seamless user experience to skyrocket conversions

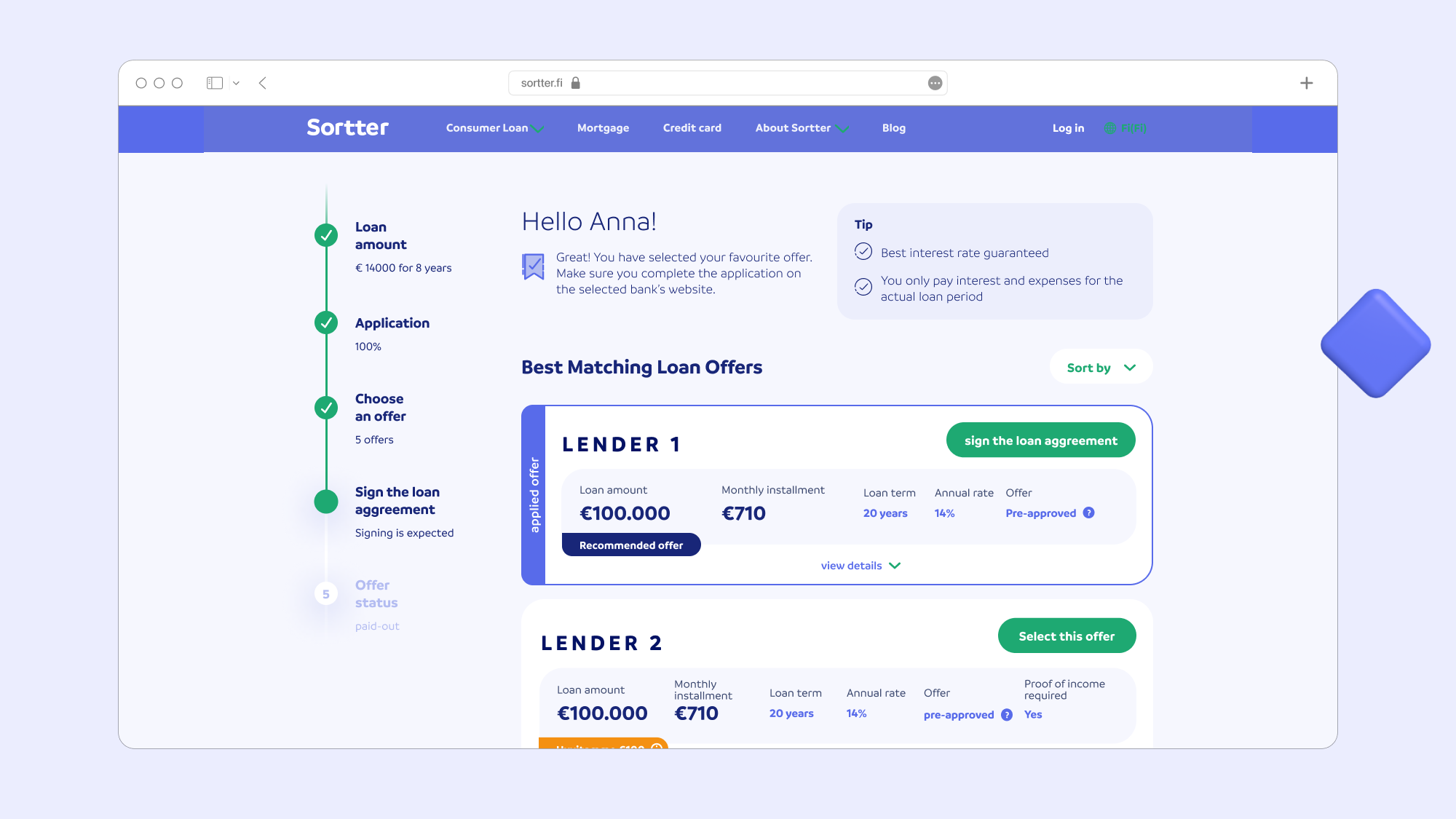

Once a user finds Sortter’s website, all eyes are on the number of checkouts. Upon their visit to the site, loan seekers have to answer certain personal financial questions, based on which the platform automatically calculates their risk profile.

Needless to say, if not optimised correctly, this flow can get really tiresome for most users resulting in a high number of them churning out. With the number of checkouts being the key indicator of Sortter’s success, we surely wanted to avoid this scenario.

So, we gave our all to design a heavily streamlined journey that reduces the interaction needed from the users to the absolute essential, helping them get through the flow as soon as possible.

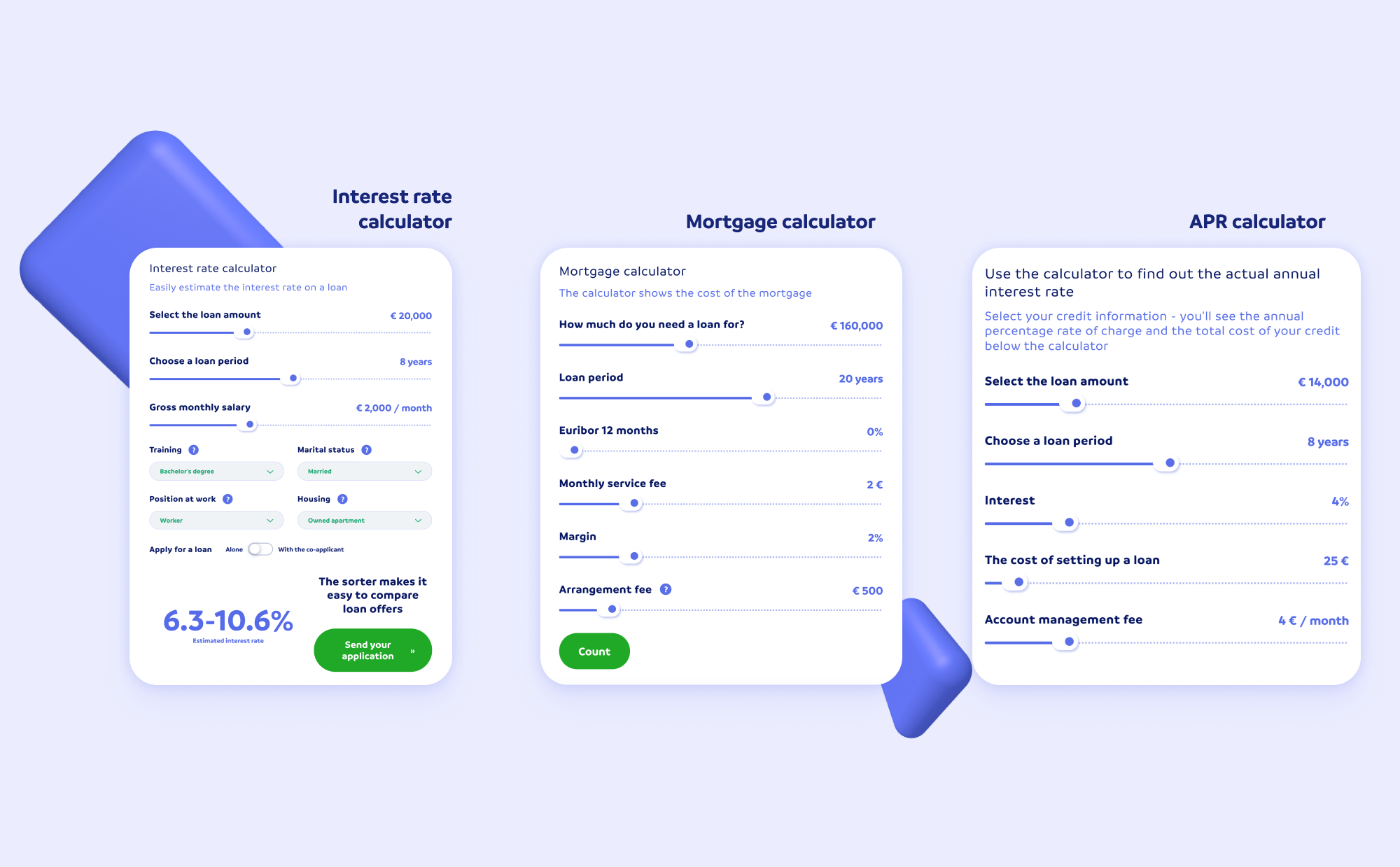

We strived to design the calculators, the first interaction points to be as simple as possible. We kept in mind that their ultimate purpose was to help customers find out about the cost of a loan before applying with the least possible effort.