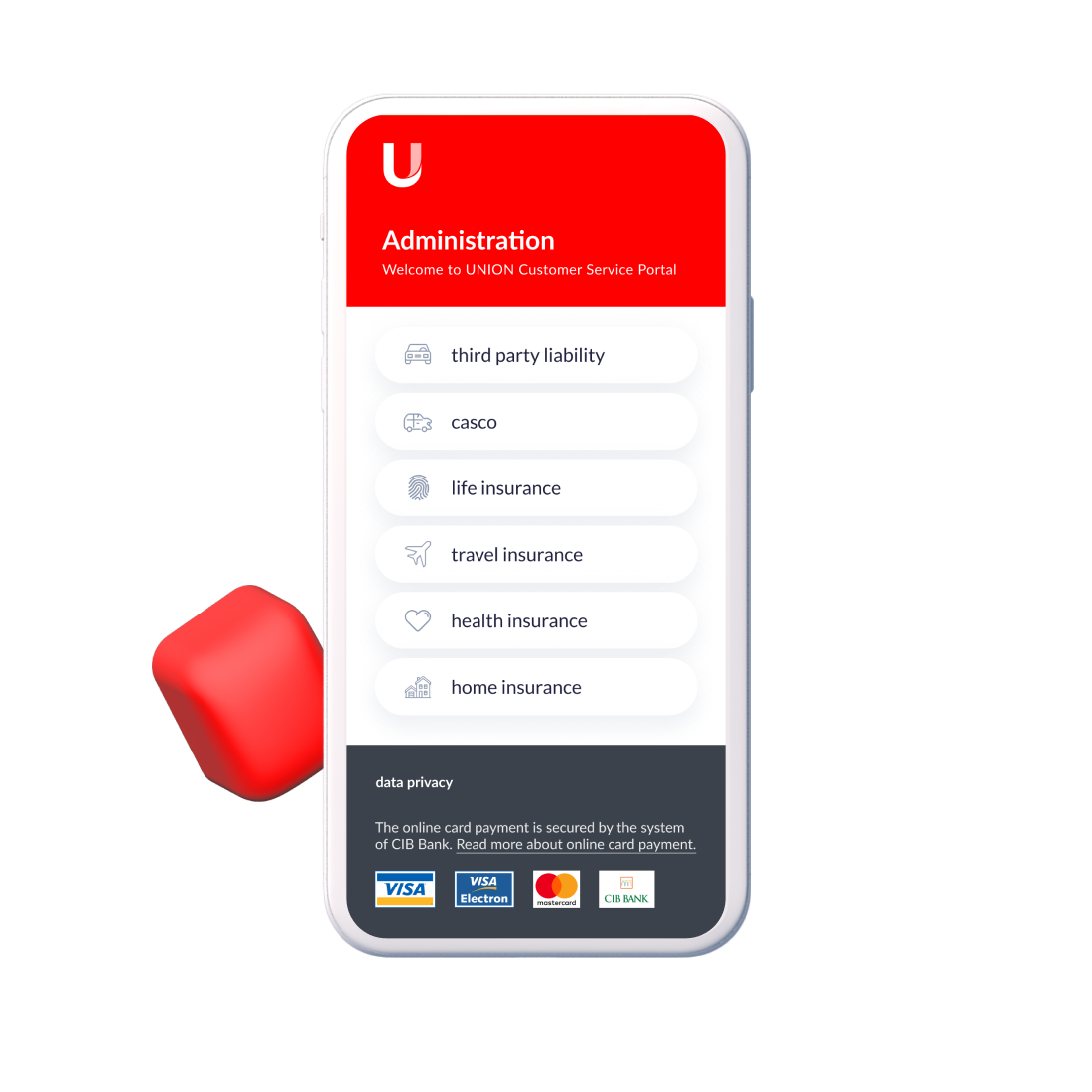

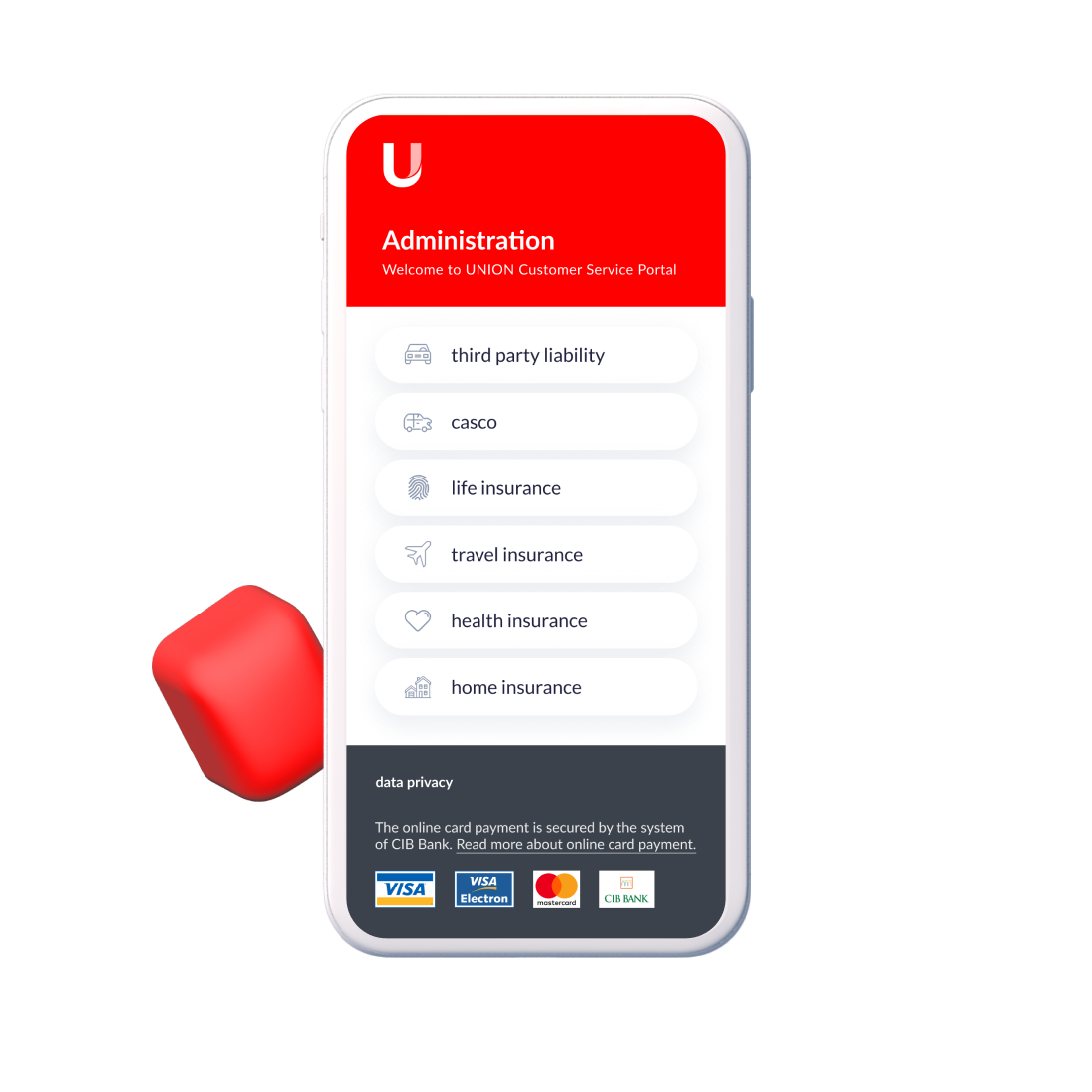

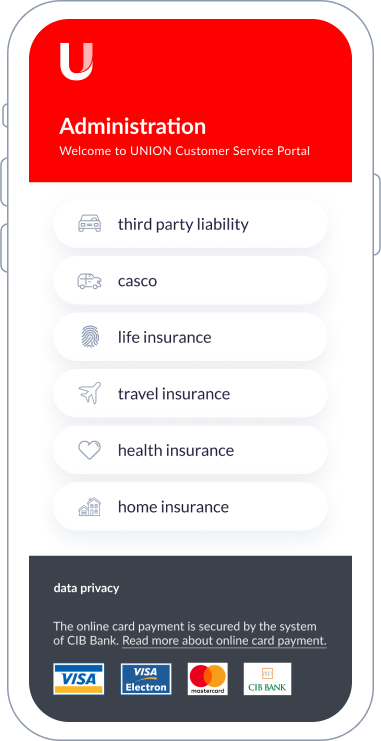

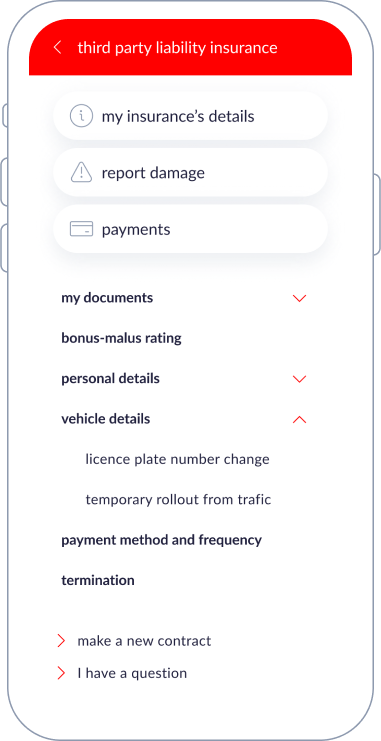

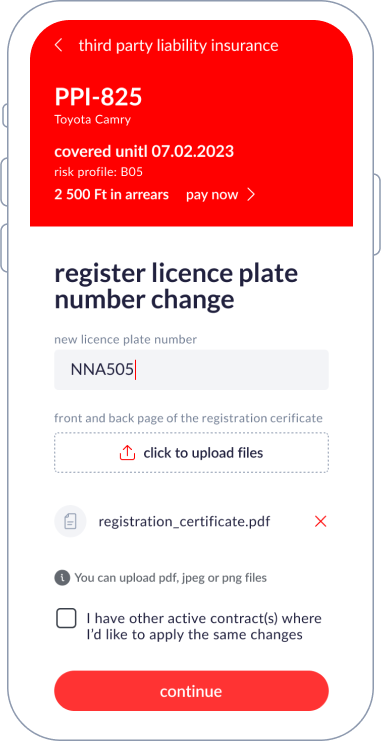

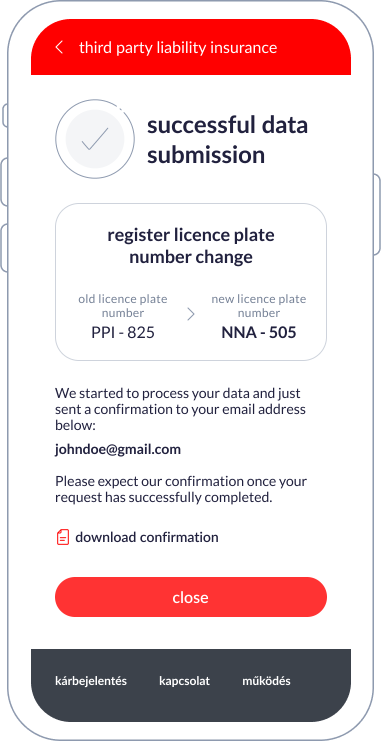

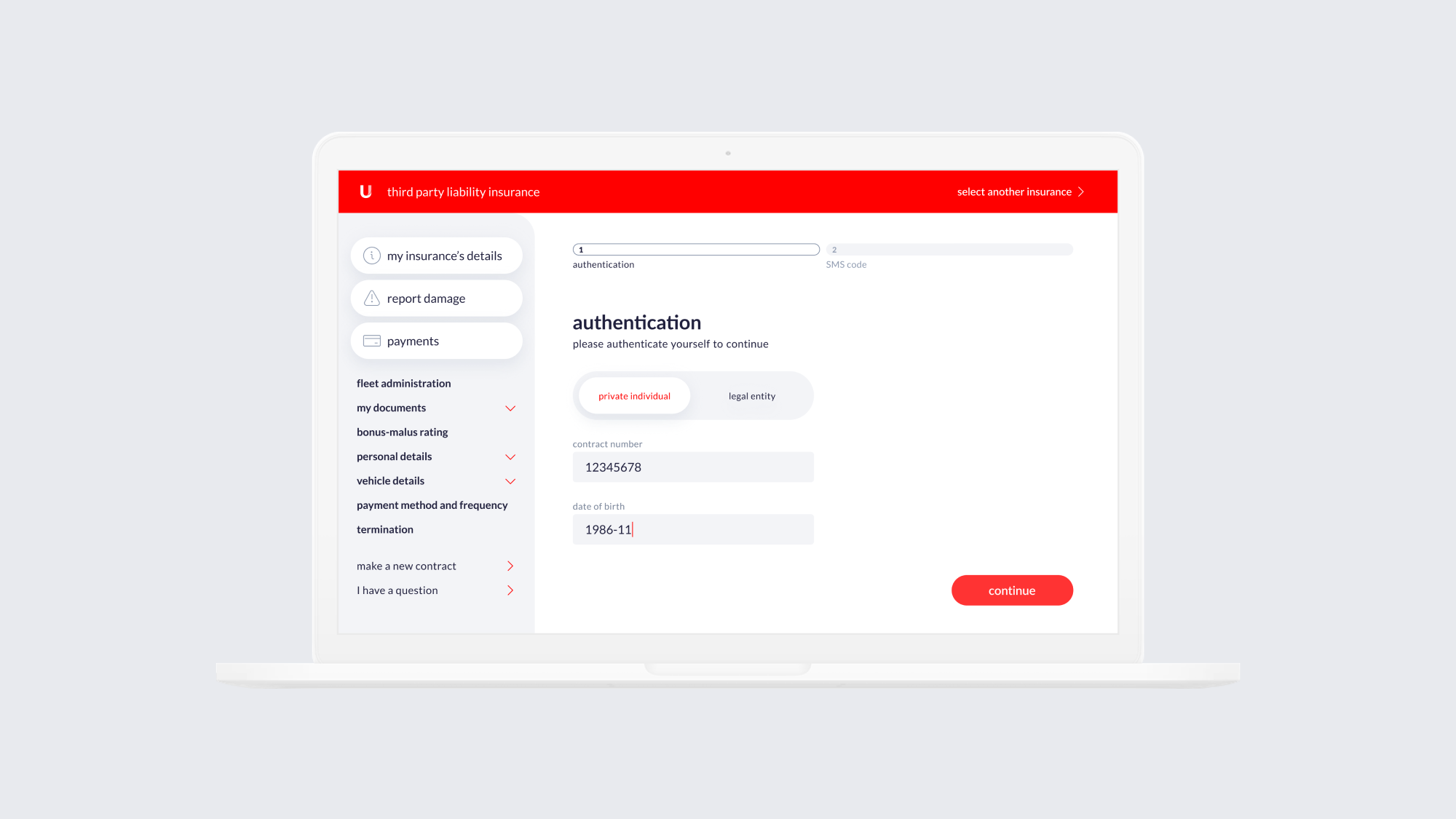

In practice, this means that users first select the insurance case they need to deal with, then they authenticate themselves using their personal data and contract number. Once this is done, they find themselves right at the desired form, where we lead them through their case.

To ensure they succeed in their tasks, we needed to stick to plain language while leaving users alone with their administration. Insurance terminology can be confusing, so we strived to provide as clear instructions as possible.

The result is a win-win scenario for both UNION and its clients: the administration effort and frustration can be minimized while the efficiency and the feeling of comfort is maximized.

Keeping it secure

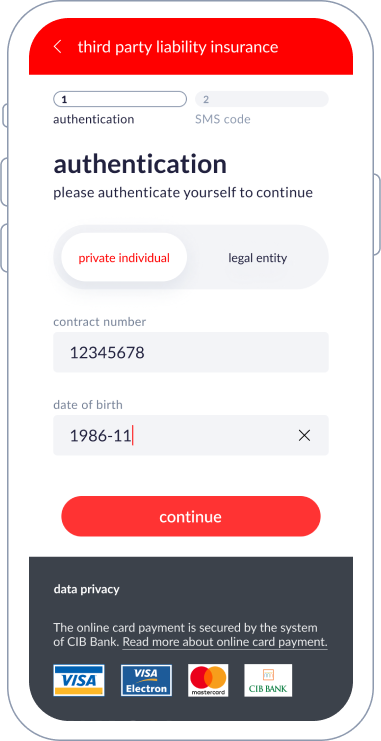

In-person administration might seem very old school, but it brings a layer of security to the whole process. To gain (and keep) the trust of clients, our goal was to make the administration as safe as it would be if each user were authenticated by a human.

We introduced two levels of authentication, allowing users to access a different granularity of sensitive personal information. To further maximize security and the feeling of trust, we kept inviting lower authenticated users to opt-in for the two-factor authentication.