Search results 9 results

the case for switching to a modern data platform

26 May 2025

why insurance companies need to up their game and how to get started

AI in insurance: your shortcut to understanding modern data platforms

21 May 2025

Learn how an AI-infused modern data platform can improve insurance from automated underwriting to proactive risk assessment & fraud detection.

Empowering cyber insurance through prevention tech

28 November 2023

The prevalence of cyber threats continues to escalate, underscoring the growing need for cyber insurance and for more robust prevention measures. In this article we dive deep into the realm of cyber insurance, exploring its significance for not just enterprises but also families and individuals. At the heart of this evolving landscape lies the pivotal role of prevention technology—innovative solutions designed to fortify digital defenses and mitigate risks.

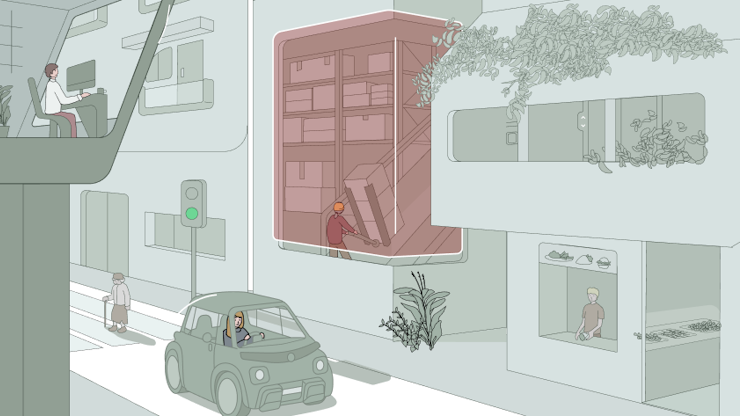

Property Insurance: Safeguarding homes with Prevention Tech

16 November 2023

For most people, their home is more than just the largest asset they’ll ever own; it’s the focal point of their family life and the foundation of feeling secure. Prevention tech for homes goes beyond protecting losses and creates opportunities to make homes safer altogether. In this article, we explore various aspects of prevention technology in property insurance, examining existing examples and industry practices, including the innovative use of smart home devices.

Prevention tech in auto insurance

30 October 2023

Get an overview of the usage-based car insurance landscape and check out three inspiring prevention offerings from the auto insurance industry.

Prevention tech in commercial insurance

08 June 2023

Compared to personal insurance lines, the higher costs and damages from commercial claims increase the need for prevention services. Commercial losses can be more widespread and impact a wider range of people, including customers, business partners, supply chains, and stakeholders. As a result, executives bring a different approach to insurance and risk prevention for their companies, making investments in risk prevention services more attractive and necessary.

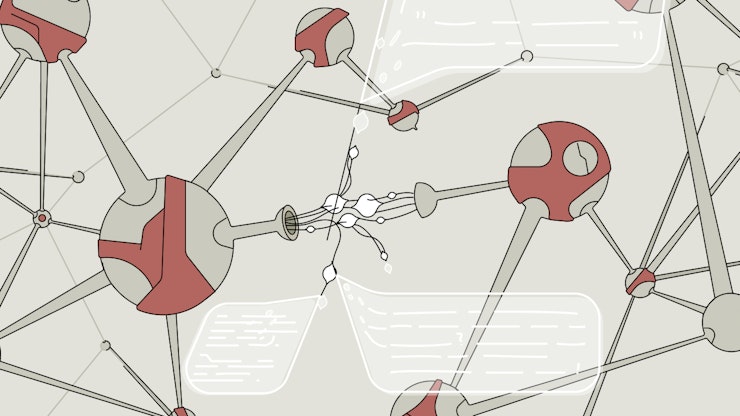

Harnessing the power of GPT-4

18 April 2023

In the rapidly evolving world of technology, it can be difficult to keep up with the latest developments. This is especially true in the field of generative AI, where breakthroughs seem to happen every day. We pride ourselves on being early at the party when it comes to new technologies, so we've updated our whitepaper, first published in February, with new insights on the latest GPT-4 version which is even more powerful and reliable than its predecessors. Read on to learn more about the latest developments in generative AI and how they're shaping the future of the insurance industry.

Shifting from financial protection

to harm prevention

23 March 2023

In today's digital age, the insurance industry is constantly evolving to keep pace with technological advancements and changing customer expectations. One significant development in this sector is the rapid emergence of prevention technology and services. By utilizing innovative solutions such as sensors, data analytics, and artificial intelligence, insurers can now proactively identify and mitigate risks before they occur. This not only benefits customers by reducing the likelihood of claims but also presents a significant opportunity for insurers to improve profitability and customer retention.

Whitepaper: Prevention tech in insurance

22 February 2023

In this report we will highlight how P&C insurers are using prevention tech to make customers safer and reduce harm - including an overview of leading prevention experiences across home, auto, commercial, and cyber.